A Project on “Impact of Foreign Direct Investment on Economic Growth in Nigeria” was submitted by Soyode Esther Omolade (from Olabisi Onabanjo University, Agoiwoye, Ogun State) to extrudesign.com.

Compound Interest Formula, calculator and download excel tool

Introduction

1.1 Background To The Study

The key component of the movement towards economic globalization or economic integration in the world economy is foreign capital flows, in other words, foreign direct investment. The need for foreign capital to complement domestic resources in the economic growth process has been welcomed as a catalyst for development since it is considered as the central element of the process of economic growth. Its origin does not matter. In the face of resource deficiency in financing longterm development, the capitaldeficient economies have heavily resorted to foreign capital as the primary means to achieve rapid economic growth.

Findlay (1978) and Wang and Blooms (1992) stressed the importance of FDI as a conduit for transferring technology, as it relates to the Foreign Investment inflows to manufacturing or service. Promoting and facilitating technology transfer through foreign direct investment (FDI) has assumed a prominent place in the strategies of economic revival and growth being advocated by policymakers at the national, regional and international levels because it is considered to be the key to bridging the technology and resource gap of underdeveloped countries and avoiding further buildup of debt (UNCTAD, 2005).

Unfortunately, the growth experience of Nigeria in the accumulation of foreign direct investment has not been very satisfactory. Hence, they accumulate huge external debt about the gross domestic product and face serious debt servicing problems in terms of foreign exchange flow and also walloping in abject poverty. Conversely, the experience of a small number of fastgrowing EastAsian newly industrialized nations has strengthened the belief that foreign capital is the central element of the process of economic development since it could bridge the resource gap of these economies and avoid further buildup of debt while tackling the causes of poverty directly.

Foreign capital flows consist of the movement of financial resources from one country to another. In this context, capital flow is a broad term that includes different kinds of financial transactions such as; lending by governments, and international organizations; bank lending, short and longterm; investment in public or private bonds; investment inequities; and direct investment in productive capacity.

Hence, foreign direct investment (FDI) can, therefore, define as “an increase in the book value of the net worth of investment in one country held by investors of another country where the investments are under the managerial control of the investor” (Graham, 1995). Todaro and Smith (2003) noted that most FDI is subsidiaries of Multinational Corporations (MNCs) such that the investors are the parent organizations of firms. Ajayi (2003) said that of all the capital inflow into the Nigerian economy from other countries, an increase in FDI is the most promising policy due to its potential in dealing with the problems of savings gap, shortage of technology and needed skills. Haiss and Steiner (2006) suggest the level and quality of foreign investment influences the financial sectors’ contribution to growth in emerging markets. Muntah, Khan, Haider and Ahmad (2015) opined that foreign direct investment contributes significantly to the human resource development, capital formation and organization and managerial skills of the people in an economy.

Thus, foreign direct investment flows represent the expansion of the international activities of Multinational Corporations. Foreign direct investment does not include all investments across the border. Some features make foreign direct investment different from other international investments. FDI is the investment made by a company outside its home country.

Since the Asian crisis, the call for an accelerated pace of opening up to FDI has intensified in the belief that this will bring not only more stable capital inflows but also greater technological knowhow, higherpaying jobs, entrepreneurship and workplace skills and new export opportunities. Many developing countries and continents see attracting FDI as an important element in their strategy for economic growth and development. This is most probably because FDI is seen as an amalgamation of capital, technology, marketing, and management.

It should be noted that while an enquiry is made about the contribution of FDI inflows to aggregate investment, this contribution could come through at least two other channels. First, FDI inflows are generally associated with transfers of technology and managerial skills and could generate externalities in the form of positive productivity spillovers to domestic enterprises in recipient developing countries. Secondly, FDI inflows could improve the recipient developing countries access to global markets and could thus help promote export orientation, which in turn could lead to an acceleration of economic growth ( Obadan, 2004).

Further, the empirical linkage between FDI and economic growth in Nigeria is yet unclear, despite numerous studies that have examined the influence of FDI on Nigeria’s economic growth with varying outcomes (Oseghale and Amonkhienan, 1987; Odozi, 1995; Oyinlola, 1995; Adelegan, 2000; Akinlo, 2004). The potential advantages of the FDI on the host economy are that it facilitates the use and exploitation of local raw materials, introduction of modern techniques of management and marketing, provision of easy access to new technologies and could be used for financing current account deficits. Poor domestic output makes an economy to rely solely on foreign direct investment exposing the economy to the problem of balance of payment deficit (Olokoyo, 2012; Noko, 2016).

1.2 Statement Of The Problem

Despite the plethora of incentives to attract foreign direct investment, the performance of foreign investment in terms of quantum is still very unimpressive and indeed disappointing in Nigeria. Most countries all over the world strive to attract foreign direct investment (FDI) because of its acknowledged advantages as a tool for economic development (Egwaikhide, 2012). Nigeria joined the rest of the world in seeking FDI as evidenced by the formation of the New Partnership for Africa’s Development (NEPAD), which has the attraction of foreign investment to Africa as a major component. Foreign Direct Investment (FDI) is assumed to benefit a poor country like Nigeria, not only by supplementary domestic investment but also in terms of employment creation, transfer of technology, increased domestic competition and other positive externalities (Ayanwale, 2007).

However, despite Nigeria involvement and effort in attracting foreign direct investment, Nigeria is still facing an economic crisis situation featured by inadequate resources for longterm development, high poverty level, low capacity utilization, high level of unemployment, and other Millennium Development Goals (MDGs) increasingly becoming difficult to achieve by 2020 (Dutse, 2008). In fact, one of the pillars of which the New Partnership for Africa’s Development (NEPAD) was launched was to increase available capital to US$64 billion through a combination of reforms, resource mobilization and a conducive environment for FDI (Funke and Nsouli, 2003).

The UNCTAD World Investment Report 2006 shows that Foreign Direct Investment (FDI) inflow to West Africa is mainly dominated by inflow to Nigeria, who received 70% of the subregional total and 11% of Africa’s total. Out of this, Nigeria’s oil sector alone received 90% of the FDI inflow. However, despite the increase in the inflow of FDI in Nigeria compare to another part of Africa especially in West African countries about 60 percent of Nigerian population lives on less than US$1 per day. Which have prompted so many researchers to doubt the significant impact of FDI on economic growth of Nigeria, thus this research aim to establish if economic growth leads to the rise of foreign direct investment or foreign direct investment is the one leading to economic growth.

1.3 Research Questions

In order to address the aforementioned problem as identified in the statement of the problem, the following researchable questions are considered:

- To what extent has foreign direct investment impacted on the economic growth of Nigeria?

- What is the causal relationship that exists between foreign direct investment and Nigeria economic growth?

- Is there any observed long run relationship between economic growth and foreign direct investment in Nigeria?

- Is foreign direct investment affected by government policies?

- What factors retard the adequate contribution of foreign direct investment to economic growth?

1.4 Objectives Of Study

The broad objective of this study is to investigate the impact of foreign direct investment on Nigeria economic growth at large, while the specific objectives include the following:

- To empirically investigate the extent at which foreign direct investment has impacted on the economic growth of Nigeria.

- To ascertain the causal relationship that exists between foreign direct investment and Nigeria economic growth.

- To determine if there is any observed long run relationship between economic growth and foreign direct investment in Nigeria.

1.5 Research Hypothesis

The working hypothesis of the study is stated as follows:

H0: There is no significant impact of foreign direct investment on the economic growth in Nigeria.

H1: There is a significant impact of foreign direct investment on the economic growth in Nigeria.

1.6 Scope Of The Study

This research will analyze the impact of foreign direct investment on Nigeria economic growth, taking a good analysis on various ways and means put by the government of Nigeria to develop and attract foreign direct investment from 19902017. The inflow of FDI was at their relative peaks in 1990, 1993, 1995, 1998, 2000 and 2003. All these occurred due to various policy reforms such as the Structural Adjustment Program that the government introduced to boost investment.

This range of years entails the period of consistent fluctuation in the value of foreign direct investment in Nigeria which is caused by various investment policies and political instability. The contribution of FDI inflow to GDP and Gross Fixed Capital Formation since the inception of the democratic regime of President Olusegun Obasanjo in 1999 supported the fact that the various policy reforms are yet to boost FDI inflow in Nigeria.

1.7 Significance Of The Study

This study aims at investigating the impact of foreign direct investment on Nigeria economic growth at large and hence, its impact cannot be overemphasized. The study will be of great importance to policymakers, government and its agencies in formulating effective policies aimed at improving Foreign Direct Investment, realizing the role in nation-building or economic growth. The study will be also of great importance to students of economics and other researchers who may have an interest in foreign direct investment and its impact on Nigeria economy. Finally, the findings of this study would add to the stock of econometric literature of Nigeria.

Literature Review

This chapter reviewed related literature; it highlights the conceptual framework of the study, which states the possible courses of action and presents the preferred approach to the research thought of the study. It further enumerates the theoretical framework of the research, on which it is entrenched and draws inferences from.

2.1 Conceptual Review

2.1.1 Investment

In Keynesian terminology, investment refers to real investment, which adds to capital equipment. It leads to an increase in the level of income and production by increasing the production and purchase of capital goods. Investment thus includes new plants and equipment, construction of public works like roads, dams, buildings. In the words of John Robinson, “By investment, is meant an addition to capital, such as an addition to capital, such occurs when a new house is being built or a new factory is built. Investment means making an addition to the stock of goods in existence (Romer, 1986).

Types of Investment

- Induced Investment: Induced investment is profit or income motivated. Factors like prices, wages and interest changes, which affect profits, influence induced investment. Similarly, demand also influences it. When income increases, consumption demand also increases and to meet this investment also increases.

- Autonomous Investment: This investment is independent of the level of income and is thus income inelastic. It is influenced by exogenous factors like innovations, inventions, and growth of population and labor force and so on. But it is not influenced by changes in demand; rather, it influences the demand. The Keynesian Theory of investment places emphasis on the importance of interest rates in investment decisions. But other factors also enter into the modelnot least the expected profitability of an investment project. Changes in interest rates should have an effect on the level of planned investment undertaken by private Sector businesses in the economy. However, a fall in interest rates should decrease cost of investment relative to the potential yield and as a result planned capital investment projects on the margin may become worthwhile. There is inverse relationship between investment and rate of interest.

- Physical/Real Investment: This is when proportion of present income is saved and invested to argument future output and income. New factories, machineries, equipment and materials increase the physical capital stock of a nation, which is the total net real value of all physical productive capital goods, making it possible for expanded output levels to be achieved.(Todaro& Smith, 2006).

According to Nwankwo (2007), foreign investment is a type of investment whether in real or financial assets across the national boundaries of the investors with the aim of maximizing the objective function of the investors which can be undertaken by individuals, firms or the government. Basically, foreign investment falls into two broad categories, which are:

- Portfolio investment: This is an investment in which an investor lacks control over the investment. It typically takes the form of investments in financial assets such as bonds and stocks in which the investor does not have controlling interest. The major motivating factor is the favorable interest rate differential that is, capital flow from where it is plentiful to where it is scarce. Portfolio investment can equally be called FDI where you do not have to be involved in the management.

- Direct investment: direct investment is an investment in a foreign country where the investors retain control over the investment. According to Aremu (2000), FDI shows that the owner of the money is coming to direct the affairs. He has an effective voice in the management. FDI typically takes the form of a foreigner setting up a subsidiary or taking over/control of an existing firm in the country in question.

Usman (2008) asserted that FDI involves the internationalization of products to serve markets that were formally served by experts. Also, FDI is distinguished from other forms of foreign investment by the fact that it involves not only foreign investment ownership but also foreign control. In other words, FDI occurs only if an individual or organization in a foreign country gains sufficient interest in an operation to acquire control. Therefore, FDI as a concept differs from international or foreign investment which is a much wide concept.

An effective voice in the management means that the foreign investor has the potential to influence or participate in the management of an enterprise. It does not mean that he/she must have absolute control. Generally speaking, investment is the commitment of funds or savings to a specified project with the primary motive of achieving a primary objective which could be profit, fame or goodwill. Foreign investment is the ownership of property abroad, usually in a company for a financial return. FDI is a subset of foreign investment when control follows the investment. So, investment is called direct when the concept of control is introduced to it.

In addition, direct investment possesses some other features such as the commitment of capital, personnel and technology between countries and access to foreign materials for either resource of precuts. The ownership of a controlling interest in a foreign operation is the highest type of commitment to foreign operations. For an investment to be considered direct then there has to be either a minimum of 10 or 25% ownership of the voting rights or shares in a foreign enterprise. The concept of control is very important in the operation of FDI because in most cases, it is the single most important fact that motivates investors to be willing to transfer technology and other competitive assets. Even though many researchers have tried to explain the phenomenon of FDI, we cannot say there is a general theory accepted. But, according to Kindleberger (1969), if everyone agrees on one point, in a world characterized by perfect competition, FDI would no longer exist. Thus, if markets work effectively and there are no barriers in terms of trade or competition, international trade is the only way to participate in the international market. There must be a form of distortion that determines the realization of direct investment, and Hymer was the first who noticed this. He believes that local firms will always be better informed about the local economic environment, and for FDIs to take place, foreign firms must possess certain advantages that allow their investment to be viable and the market of these benefits has to be imperfect (Kindleberger, 1969).

From a macroeconomic point of view, FDI is a particular form of capital that flows across borders, from countries of origin to host countries, which are found in the balance of payments. The variable of interest is Capital flows and stocks revenues obtained from investments. The microeconomic point of view tries to explain the motivations for investment across national boundaries from the point of view of the investor. It examined the consequences to investors, the country of origin and the host country of the operations of the multinationals rather than investment flows and stock (Lipsey, 2001).

The first attempt to explain FDI was considered by Ricardo’s theory of comparative advantage (Hosseini, 2005). However, FDI cannot be explained by this theory, which is based on two countries, two products and perfect mobility of factors at the local level. Such a model cannot even allow FDI. Thus, as Ricardo’s comparative advantage theory fail to explain the rising share of FDI, other models were used, such as portfolio theory (Hosseini, 2005). This theory was designed to fail because it explained only the achievement of foreign investments in a portfolio, but could not explain the direct investments. According to the theory, as long as there is no risk or barriers in the way of capital movement, the capital will go from countries with low interest rates to countries with high-interest rates. But these allegations have no basis in reality, and the introduction of risk and barriers to capital movement erodes the veracity of the theory, and capital can move freely in any direction (Hosseini, 2005). Although more realistically, the new theories of international trade still cannot capture the entire complexity of FDI and other forms of international production.

The new theories of international trade, still cannot explain foreign direct and other forms of international investment (Hosseini, 2005). Robert Mundell (Mundell, 1957) has tried to explain the FDI through a model of international trade, involving two countries, two goods, two production factors and two identical production functions in both countries where production of a good requires a higher proportion of a factor than the other. Mundell’s model could not also explain international production through FDI because foreign investment incorporated portfolio investment or short term investment. Japanese researchers Kojima and Ozawa also tried to create a model to explain both international trade and FDI (Kojima and Ozawa, 1984). They started from the model developed by Mundell and tried to develop it and improve on it. Thus, in the model developed by the two Japanese, FDI takes place if a country has a comparative disadvantage in producing a product, while international trade is based on comparative advantage. Internalization theory (Vintila, 2010) explains the growth of the multinational enterprise (MNE) and gives insights into the reasons for FDI.

2.1.2 Foreign Direct Investment

FDI is an investment made to acquire a lasting interest in or effective control over an enterprise operating outside of the economy of the investor. FDI net inflows are the value of inward direct investment made by nonresident investors in the reporting economy, including reinvested earnings and intracompany loans, net of repatriation of capital and repayment of loans. FDI net outflows are the value of outward direct investment made by the residents of the reporting economy to external economies, including reinvested earnings and intracompany loans, net of receipts from the repatriation of capital and repayment of loans (Odozie, 1995). This is the category of international investment that reflects the objective of a resident entity in one economy to obtain a lasting interest in an enterprise resident in another economy. (OECD, 2007). This is an increase in the book value of the net worth of investment in one country held by investors of another country where the investments are under the managerial control of the investor” (Graham, 1995).

According to the IMF and OECD definitions, the direct investment reflects the aim of obtaining a lasting interest by a resident entity of one economy (direct investor) in an enterprise that is resident in another economy (the direct investment enterprise). The “lasting interest” implies the existence of a longterm relationship between the direct investor and the direct investment enterprise and a significant degree of influence on the management of the latter. Direct investment involves both the initial transaction establishing the relationship between the investor and the enterprise and all subsequent capital transactions between them and among affiliated enterprises, both incorporated and unincorporated. It should be noted that capital transactions that do not give rise to any settlement, e.g. an interchange of shares among affiliated companies, must also be recorded in the Balance of Payments.

The fifth edition of the IMF’s Balance of Payment Manual defines the owner of 10% or more of a company’s capital as a direct investor. This guideline is not a fast rule, as It acknowledges that a smaller percentage may entail a controlling interest in the company (and, conversely, that a share of more than 10% may not signify control). But the IMF recommends using this percentage as the basic dividing line between direct investment and portfolio investment in the form of shareholdings. Thus, when a non resident who previously had no equity in a resident enterprise purchases 10% or more of the shares of that enterprise from a resident, the price of equity holdings acquired should be recorded as direct investment. From this moment, any further capital transactions between these two companies should be recorded as a direct investment. When a non resident holds less than10% of the shares of an enterprise as portfolio investment and subsequently acquires additional shares resulting indirect investment (10% or more), only the purchase of additional shares is recorded as direct investment in the Balance of Payments. The holdings that were acquired previously should not be reclassified from portfolio to direct investment in the Balance of Payments but the total holdings should be reclassified in the IIP. Concerning the terms,, direct investor and direct investment enterprise, the IMF and the OECD define them as follows.

A direct investor may be an individual, an incorporated or unincorporated private or public enterprise, a government, a group of related individuals, or a group of related incorporated and/or unincorporated enterprises which have a direct investment enterprise, operating in a country other than the country of residence of the direct investor. A direct investment enterprise is an incorporated or unincorporated enterprise in which a foreign investor owns 10% or more of the ordinary shares or voting power of an incorporated enterprise or the equivalent of an unincorporated enterprise. Direct investment enterprises may be subsidiaries, associates or branches. A subsidiary is an incorporated enterprise in which the foreign investor controls directly or indirectly (through another subsidiary) more than 50% of the shareholders’ voting power. An associate is an enterprise where the direct investor and its subsidiaries control between10% and 50% of the voting shares. A branch is a wholly or jointly owned unincorporated enterprise. It should be noted that the choice between setting up either a subsidiary/associate or a branch in a foreign country is dependent, among other factors, upon the existing regulations in the host country (and sometimes in its own country, too). National regulations are often more restrictive for subsidiaries than for branches but this is not always the case.

2.1.3 Direct investment classification, components and sectorial breakdown

The classification of direct investment is based firstly on the direction of investment both for assets or liabilities; secondly, on the investment instrument used (shares, loans, etc.); and thirdly on the sector breakdown. As for the direction, it can be looked at it from the home and the host perspectives. From the home one, financing of any type extended by the resident parent company to its nonresident affiliated would be included as direct investment abroad. By contrast, financing of any type extended by non resident subsidiaries, associates or branches to their resident parent company is classified as a decrease in direct investment abroad, rather than as a foreign direct investment. From the host one, the financing extended by nonresident parent companies to their resident subsidiaries, associates or branches would be recorded, in the country of residence of the affiliated companies, under foreign direct investment, and the financing extended by resident subsidiaries, associates and branches to their nonresident parent company would be classified as a decrease in foreign direct investment rather than as a direct investment abroad. This directional principle does not apply if the parent company and its subsidiaries, associates or branches have crossholdings in each other’s share capital of more than 10%.

As for the instruments, direct investment capital comprises the capital provided (either directly or through other related enterprises) by a direct investor to a direct investment enterprise and the capital received by a direct investor from a direct investment enterprise. Direct investment capital transactions are made up of three basic components:

- Equity capital: comprising equity in branches, all shares in subsidiaries and associates (except nonparticipating, preferred shares that are treated as debt securities and are included under other direct investment capital) and other capital contributions such as provisions of machinery, etc.

- Reinvested earnings: consisting of the direct investor’s share (in proportion to direct equity participation) of earnings not distributed, as dividends by subsidiaries or associates and earnings of branches not remitted to the direct investor. If such earnings are not identified, all branches’ earnings are considered, by convention, to be distributed.

- Other direct investment capital (or intercompany debt transactions): covering the borrowing and lending of funds, including debt securities and trade credits, between direct investors and direct investment enterprises and between two direct investment enterprises that share the same direct investor. As it has been mentioned before, deposits and loans between affiliated deposit institutions are recorded as other investment rather than as direct investment.

2.1.5. Economic Growth

Economic growth is the sustained expansion of production possibilities measured as an increase in the real GDP over a given period. By economic growth, economists generally mean the increase over time in a country’s real output per capita. Though other measures can be used, the output is most conveniently measured by the gross national product (GNP). This implies that economic growth is measured by the increase in a country’s per capita GNP, (Uzoigwe, 2007).

Economic growth as a concept is viewed differently by different scholars. This is attributed to the condition prevailing at the time of these scholars. The majority accept it as an increase in the level of national income and output of a country. Wagner (1883) emphasized economic growth as the fundamental determinant of public sector growth. However, Keynes (1936) stated that public expenditure is a fundamental determinant of economic growth. According to Dewett (2005), it implies an increase in the net national product in a given period of time. Todara and Smith (2006) defined economic growth as a steady process by which the productive capacity of the economy is increased over time to bring about rising levels of national output and income. Jhingan (2006) viewed economic growth as an increase in output. He explained further that it is related to a quantitative sustained increase in a country’s per capita income or output accompanied by an expansion in its labour force, consumption, capital and volume of trade.

2.2 Theoretical Review

The theoretical framework of the study enumerates the theories on which the concept of the research is based. These theories specifically highlight the need for foreign capital by developing regions of the world, and how these flows of foreign investment can beneficially increase output and economic activities of host economies, as benefits are essentially sustained over the years for economic development.

2.2.1 The TwoGap Theory

Chenery and Strout (1966) identified three development stages in which growth proceeds at the highest rate permitted by the most limiting factors; the skill limit, savings gap, and the foreign exchange gap. At early development stages, growth is likely to be investment limited as experienced by most developing economies. It is expected that foreign skill and technology reduce skill limit, investment reduces savings limit and foreign exchange limit equally. Since these gaps limit development, if they are closed, then there is development possibility.

In the national income equation:

Y= C + I + (X – M)……………………………………………………………. (1)

To derive savings equation;

S = Y C…………………………………………………………………………. (2)

Where; C = Consumption, I = Domestic capital formation or Investment X = Export, M = Import and S = Savings.

Therefore, to derive our Y from equation (2)

Y = C + S…………………………………………………………………………. (3)

We therefore equate the two equations (1) and (3) National income = C + I + (X – M) = C + S

We subtract C from both sides;

I + (X – M) = S

I = S + (M – X)………………………………………………………………….. (4)

If M > X

Therefore deficit in the balance of payments (BOP); and a need for financing.

This is the Foreign exchange gap

M – X = F……………………………………………………………………….. (5)

Where F = capital import.

Therefore, I = S + F (this means actual savings gap equals actual foreign exchange gap). IS = F……………………………………………………………………………………… (6)

This well is the savings gap that needs to be closed by capital import.

However, excess planned investment over savings might differ from the amount of excess planned import over export.

If (I – S) > (M – X), then all investment will not be realized.

The required foreign assistance equals the larger of the two gaps. If the foreign exchange gap is greater than the savings gap, import reduces and foreign capital reduces, as well as inputs available for development efforts, therefore making growth limited. The import of capital for the foreign exchange gap will remove the limitation placed on trade and therefore close the trade gap.

A country can increase its new capital formation or investment through its own domestic savings and inflow of capital from abroad. The inflow of foreign capital enables a country to spend more than it produces, as seen in equation (5); this again is the foreign exchange gap. It also enables a country to invest more than it saves, as seen in equation (6); this is the savings gap. The closing of these gaps that limit development by foreign capital has the primary aim of gradually reducing reliance on foreign capital as an economy surges towards economic development.

2.2.2 Hymer Theory

Hymer (1976), in his theory,,, stated that developing countries have low per capita income and therefore a high rate of return on investment. This is so because; an inverse relationship exists between income per capita and the rate of return on investment. This invariably draws the flow of foreign capital to developing economies that have a high rate of return on investment. The early stage of development desires more capital as domestic savings is low. As development proceeds, the need for capital gradually declines and domestic savings gradually increases.

2.2.3 HeckscherOhlin (HO) Theory

The theory of what determined a nations’ trade pattern developed in Sweden from Heckscher (1919) and Ohlin (1933). It states that those commodities requiring for their production much of (abundant factors of production) and little of (scarce factors) are exported in exchange for goods that call for factors in the opposite proportion. Thus indirectly, factors in abundant supply are exported and factors in scanty supply are imported. The HO theory predicts that countries export the product that uses their abundant factors intensively, and import the products using their scarce resources or factors intensively. A country is relatively laborabundant if it has a high ratio of labour to other factors than does the rest of the world. A product also is said to be labour-intensive, if labour cost has a greater share of its value than the value of other products.

The factor endowment theory states that physical capital (nonhuman) and high skilled labour that is technical workers (human capital) are abundant in industrialized countries. Unskilled labour is however scarce in developed countries. This implies that the opposite pattern of abundance and scarcity of physical capital; high skilled labour, and unskilled labour is found in developing countries. Therefore for developing countries, there is a limited supply of physical capital, technology and skilled human capital.

2.2.4 The New Growth Theory

The new growth theory was stimulated by Romer (1986); it is known as the endogenous growth theory. It integrates technology in the form where it can relate with the function of the market. It incorporates technical advancement in such a way that it is a consequence of investment level, capital stock and also, human capital. The theory improved on earlier ones by emphasizing the importance of technology as a market force product. Its emphasis regarding the economy encompasses the opinion that technological progress draws on economic engagements. It also enumerates the ability of technology to relate not as static but rather with the increasing return capability towards driving the process of growth.

The theory basically emphasizes knowledge as an essential driver of growth. This is accessed in the form of the buildup of ideas and critically ensuring their maximal utilization to the extent it boosts economic growth. The point of the new growth theory is that knowledge drives growth. It accentuates a paradigm shift from the regular resource-based to knowledge-based investment into the economy. It particularly encourages new knowledge as a basis for shaping the growth of the economy.

The Solow model on the other hand is usually called the “exogenous” model of growth. It depicts technology to be an incessantly intensified knowledge collection that just became apparent with time, and not essentially existing with economic forces. This overview was the basis by which economists modelled the economy utilizing diminishing returns; however, this was done excluding technology from the economic model. The specified reason was that technology was supposedly determined by factors remote to the economy, otherwise not internally generated. (Solow 1957).

The neoclassical theory asserted that the minimal relative amount of capital to the labour of developing countries promises an extremely high investment return. The liberalization of the national market according to them draws more domestic investment, likewise foreign investment, thereby increasing capital accumulation. The resultant growth thereby of Gross National Product is similar to increasing domestic savings rate which enhances capitallabour ratio and per capita incomes in capital-poor countries. The new growth theory discards diminishing returns to capital investment assumption of the Neoclassical, therefore permitting increase to scale in the aggregation of production, the role of externality focus in determining investment return, with the assumption that public and private investment in human capital stimulate external economies for productivity improvement that counteract normal inclination of declining returns asserted by the neoclassical, the new growth economists, highlight external economies to capital buildup which can persistently make the marginal product of physical or human capital to exceed the interest rate. It puts a stop to declining returns from being made inactive thereby resulting in long term growth patterns in developing countries.

The new growth theory revisited the ancient tradition of reasoning regarding the impact of increasing returns. Economists deliberated extensively on the concern of increasing returns as definite and hypothetical occurrences (Buchanan & Yoon 1994). However as economists developed better in theory articulation it was cumbersome to include increasing returns as a factor in modelling, supposing declining returnsproduced equations are stable and could be solved mathematically. This has not been realistic mathematically based on the said assumptions, it is, therefore, understandable why economists were constrained to diminishing returns, because it had better equilibrium capability and could be wholly evaluated (Arthur 1989).

Regarding the interrelation of the reciprocity nature of investments, especially in advanced technology, alongside the recurring nature of spending in scientific research and development (R&D), the anticipation of business about growth are most possibly personally rewarding. The desire for growth in individual economies prompt their level of investment in R&D, this also will generate and maintain the level of growth attained. The increasing returns associated with innovative technology are a sufficient platform for sustainability. Conversely, the investors if sceptical, cut research and development expenditure and put in the minimal investment, thus, posing a causative factor or compounding an economic deceleration (Evans &Honkapohja 1996).

It is expected that macroeconomic policies will clearly aspire to attain and upholding greater altitudes of growth; this is due to the existing relationship linking increasing returns, anticipations and the expectation for sustained growth. The approach that embraces greater growth will be faced headlong by investing additionally in R&D. This will invariably direct investment towards innovative productive capital, which will accelerate the velocity of efficiency of growth economically, thereby, increasing income and improving the living standard of the people. (Bluestone & Harrison 2000).

2.2.5 Sustainable Livelihood Theory

The theory emerged as “the combination of the populace, available resources, immediate environment and level of development in four phases namely: controlling the level of population increase; bringing down the rate of relocation; discouraging basic abuse and maintaining better management of resources. The Brundtland Commission report (1987) was built as a combined concept. Livelihood implies availability of sufficient food supply with readily available money to meet essential requirements; security of life and property, or accessibility of resources and sufficient savings to meet future eventuality. Sustainability means the preservation or the improvement of resource efficiency over a long period of time. An adjustable approach and ability give rise to plans as well sustain a means of living for the upcoming generation. This refers to the constant transformation in the societal plan and form. These abilities are dependent on accessibility, steadiness, and openness of all alternatives, which are environmental, social, cultural, economic and political. They are based on the fairness, resource possession and joint qualitative decision making ideas of Sustainable Human Development (SHD) and Sustainable Livelihood (SL) which include the initiative of transformation and risk, (WCED, 1987).

The capital approach to sustainable development emphasized and ensures a per capita national wealth that does not deplete, as a result of preserving the sources of wealth which are; stock produced human capital, social capital and natural capital. Turner (1988) figured that the opinion for the best possible (sustainable growth) strategy pursues the preservation of a suitable level of growth in per capita real earnings, without reducing the nations’ investment reserve or indigenous environmental reserve. The World Commission on Environment and Development (WCED, 1987) opined that sustainable development is such that satisfies the necessities of the current generation yet not jeopardizing the capability of upcoming ones, toward their own necessities being met.

Solow (1993) summed that, the duty of sustainability was to equate the posterity of endowment with whatever it takes to achieve a standard of living at least as good as theirs, while similarly looking after their next generation. Also, Anand and Sen (1994) describe sustainable development as the expansion and substantive freedom of people today and making effort to avoid seriously compromising future generations. This is very similar to the Human Development Report (1994) definition of development objectives as; sustaining the freedom and capabilities that allow people to lead meaningful lives through sustainable freedom and equitable development.

The sustainable Livelihood theory emphasizes the sustainability imperative of the formation of capital, and its accumulation in the domestic investment, of host nations. The importance of the efficiency of domestic investment is a resultant higher equilibrium level of per capita income, increase in employment, and double benefit of increased production input and linkages for local firms in the domestic sector. This is accomplished through a diffusion process that encourages healthy competition and hence the efficiency of the domestic investment as a result of the flow of foreign funds. This direct contribution to the synergy enhances improved productivity and further boosts economic effectiveness which invariably results in a permanent increase in growth rates of host nations. This means to sustain and improve resource efficiency for a great span of time, and with adjustable policies and abilities to create and keep up their living standard, improve security and that of upcoming generations.

2.3 Empirical Review: FDI And Economic Growth

2.3.1 Evidence from developed countries

Agrawal (2015) assessed the relationship between foreign direct investment and economic growth in the developed economies, namely, United States, Germany, Italy, New Zealand over the period 1989 – 2012. Cointegration and Causality analysis was applied. The results indicate that foreign direct investment and economic growth are cointegrated at the panel level, indicating the presence of a long-run equilibrium relationship between them. Results from causality tests indicate that there is long-run causality running from foreign direct investment to economic growth in these economies.

Koojaroenprasit (2012) explored the impact of foreign direct investment on the economic growth of South Korea using secondary data for the period 1980–2009. Multiple regression analysis was employed in the study. This study found that there is a strong and positive impact of FDI on South Korean economic growth. Furthermore, the study indicated that human capital, employment and export also have a positive and significant impact, while domestic investment has no significant impact on South Korean economic growth. He argued that the interaction effects of FDI human capital and FDI export indicated that the transfer of high technology and knowledge harms South Korean economic growth.

Bradley, T.E & Benhua, Y. (2009) examined and assessed the differential impact of FDI on growth in eight US regions, as defined by the Bureau of Economic Analysis (BEA). The results show that the manufacturing FDI–growth relationship tends to vary across regions.

2.3.2 Evidence from emerging countries

Ullah, et al.(2009) also investigated the impact of foreign direct investment and export on the economic growth of six (6) emerging countries of Russia, Taiwan, Mexico, Pakistan, Poland and Thailand using a multivariate VAR analysis approach. The results of the study have favoured exports led growth hypothesis in most emerging countries. The study further provided evidence of the longrun impact of exports that led to the growth of FDI and GDP in Latin American countries of Mexico. The study established the existence of bi lateral causality between GDP and FDI in Thailand, while no evidence of such relationship in the case of Poland.

Ricardo, Hwang and Rodrick (2005) argued that Foreign Direct Investment (FDI) provide a path for emerging nations to export the products developed economies usually sell, in effect increasing their export sophistication. Many developing countries pursue FDI as a tool for export promotion, rather than production for the domestic economy. Typically foreign investors build plants in nations where they can produce goods for export at lower costs. BendeNabende (2002) also found that the direct long term impact of Foreign Direct Investment (FDI) on output is significant and positive for comparatively economically less advanced Turkey and Thailand, but negative in the more economically advanced Iran and Taiwan.

2.3.3 Evidence from developing countries

Pulstova (2016) studied the effects of foreign direct investment and firm export on economic growth in Uzbekistan. The study covered the period 1990 – 2014 and a descriptive method was adopted. He found that an increase in FDI may cause firms to increase their export of products.

Muntah, Khan, Haider and Ahmad (2015) studied the impact of foreign direct investment on the economic growth of Pakistan covering the period 1995 to 2011. The data were sourced from World Bank, Economy of Pakistan Books, Index Monde and Economic Survey of Pakistan. Regression analysis was used in the study. They found that FDI impacts positively on the economic growth of Pakistan.

Roman and Padureanu (2012) found that FDI and capital endowments are positively correlated with GDP in Romania, but what was not expected was the fact that the human capital was negatively correlated with GDP evolution. As the authors stated, the last fact is explained by the reduction of the Romanian population in 19952004. Foreign Direct Investment influence is still at a low level, but the indirect influence through the increase in productivity and competitiveness is more evidenced in Romania.

Asiedu (2002) examined the factors that affect FDI in developing countries and aimed at discovering if the factors affect countries in SubSaharan Africa (SSA) differently. The argument of the research was based on the findings of Jaspersen et al.,

(2000); Hausmann and Fernandez Arias (2000). The data used for analysis was cross-sectional data, and the method of analysis utilized was the cross-sectional regression, and sub period panel regression. The regression results confirm that; a greater investment return coupled with improved infrastructure, results in a positive impact on FDI to SSA countries. There is, however, no significant impact on FDI to SSA. It was observed that openness to trade encouraged FDI to SSA, therefore Africa is different. Different strategies that have been seen to be successful in other regions, could not be similarly successful in Africa.

However, the theory base of the empirical study was not clearly stated. The number of years and countries under observation could also be increased for better outcomes of results. Obwona(2001) noted in his study of the determinants of FDI and their impact on growth in Uganda that macroeconomic and political stability and policy consistency are important parameters determining the inflow of Foreign Direct Investment (FDI) into Uganda and that Foreign Direct Investment (FDI) affects growth positively but insignificant. Foreign Direct Investment (FDI) also contributes to economic growth via technology transfer.

Aitken and Harrison (1999) in their study also found a negative influence of FDI on the productivity of domestic firms in the manufacturing industry in Venezuela. According to the study, evidence from foreign investments in the service sector is ambiguous. The agriculture and mining sectors do have little spillover potential for the economy and as a result, FDI inflows are of little efficiency.

2.3.4 Evidence from Nigeria

Uwubanmwen and Ogiemudia (2016) examined the effect of foreign direct investment on economic growth in Nigeria using annual time series data covering the period 1979 to2013. The data were analyzed using Error Correction Model. The results reveal that FDI has both immediate and time-lag effects on Nigeria economy in the short run but has a non-significant negative effect on Nigeria economy in the long run.

Otto and Ukpere (2014) assessed foreign direct investments and economic development and growth in Nigeria over a 41 year period. They observed that there is a positive relationship between foreign direct investments and economic growth in Nigeria. They suggested that policies are required which will facilitate foreign direct investments into the Nigerian economy.

Nwankwo et al, (2013) investigated the impact of globalization on foreign direct investment in Nigeriasince the world has become a global village. The methodology used is purely descriptive and narrative and the data used is secondary. It was found out that foreign direct investment (FDI) has been of increased benefit to Nigeria in the area of employment, transfer of technology, encouragement of local enterprises etc. But there are certain impediments to the full realization of the benefits of foreign direct investment.

Osinubi and Amaghionyeodiwe (2010) carried out an empirical investigation of foreign private investment and economic growth in Nigeria, using co0integration and errorcorrection framework over the period covering 1970 to 2005. The study found that foreign private investment, domestic investment growth and net export growth positively influenced economic growth in Nigeria.

The research of Ayanwale (2007) examined the relationship between foreign capital inflow and economic growth in Nigeria, thereby focusing on the country’s definite focus on the foreign capital growth argument. The study considered a scope larger than previous studies in terms of the number of years and the effect of major components of FDI on economic growth. It exploited the opportunity of access to the degree of difference on the effect of oil and nonoil foreign capital on Nigeria’s economic growth. The study also examined the empirical relationship between nonextractive foreign capital and economic growth, investigating the factors of foreign capital in the Nigerian economy.

The period of analysis was 19702002, and the augmented growth model was estimated via the ordinary least square and the 2SLS method of analysis. The researcher found that; there is a negative relationship between openness and foreign capital inflow. Whereas, a positive relationship exists between both infrastructure and returns on investment and FDI, though returns on investment are not statistically significant. There is a positive relationship between FDI inflow; inflation, and government size. Whereas there is a negative relationship between FDI inflow; human capital and political stability.

Foreign investment in Nigeria imparts positively to economic growth. Even though the total impact of FDI on economic growth may not be tangible, the factors of FDI do have a positive impact.

Akunlo (2004) found that foreign capital has a small and not statistically significant effect on economic growth in Nigeria. Adelegan (2000) also explored the seemingly unrelated regression model to examine the impact of FDI on economic growth in Nigeria and found out that FDI is proconsumption and proimport and negatively related to gross domestic investment. In the same line, Ogiogio (1995) reported negative contributions of public investment to GDP growth in Nigeria for reasons of distortions.

Ariyo (1998) studied the investment trend and its impact on Nigeria’s economic growth over the years. He found that only private domestic capital consistently contributed to raising GDP growth rates during the period considered (19701995). Furthermore, there is no reliable evidence that all the investment variables considered in his analysis have any perceptible influence on economic growth. He, therefore, suggested the need for an institutional rearrangement that recognizes and protects the interest of major partners in the development of the Nigerian economy.

Anyanwu (1998) identified changes in domestic investment, change in domestic output or market size, indigenization policy and change in openness of the economy as the major determinants of FDI. Anyanwu further noted that abrogation of the indigenization policy in 1995 encouraged FDI inflow into Nigeria and that effort must be made to raise the nation’s economic growth to be able to attract more FDI.

Oyinlola (1995) also conceptualized foreign capital to include foreign loans, direct foreign investments and export earnings. Using Chenery and Stout’s twogap model (Chenery and Stout, 1966), he concluded that FDI harms economic development in Nigeria.

Odozi (1995) reports in his study on the factors affecting FDI inflow into Nigeria in both the Pre and Post Structural Adjustment Programme (SAP) eras found that the macro policies in place before the SAP were discouraging foreign investors. This policy environment led to the proliferation and growth of parallel markets and sustained capital flight.

Furthermore, Odozi(1995) in his examination of the nature, determinants and potentials of FDI in Nigeria noted that foreign investment in Nigeria was made up of mostly Greenfield, that is, it is mostly utilized for the establishment of new enterprises and some through the existing enterprises.

2.4 Gaps in the Literature

A common weakness that has been widely witnessed in the earlier studies is that they failed to control for the problem of endogeneity in accessing the relationship between Foreign Direct Investment and economic growth. This study attempts to evaluate the relationship between foreign direct investment and economic growth using the regular pooled panel data analysis, the fixed and random effect estimation and the generalized method of moments to compare results with earlier empirical works. The focal aspect of the estimation process is the use of the generalized method of moments which is capable of handling the problem of endogeneity since both FDI and GDP are endogenous in the FDIGrowth equation. (Alege & Ogundipe, 2013).

Studies have been conducted on either to examine the effect of foreign direct investment on economic growth in Nigeria but little or no study to the best of the researcher’s knowledge has jointly analyzed the effect of foreign direct investment and other components of investment on economic growth in Nigeria, other related factors of foreign direct investment are interest rate and exchange rate. Hence, this is the tenet of the study.

3. Methodology

This chapter focused on the procedures and analysis of data collected, having viewed the conceptual framework of the study, the focus of the research, therefore, shifts to data collection methods and method of analysis. The chapter, therefore, briefly emphasized the theoretical framework of the study, the model specification, apriori expectation, data sources, and the technique of estimation of the study.

3.1 Theoretical Framework

In the twogap theoretical proposition, Chenery and Strout (1966) identified three development stages in which growth proceeds at the highest rate permitted by the most limiting factors; the skill limit, savings gap, and the foreign exchange gap. At early development stages, growth is likely to be investment limited as experienced by most developing economies. It is expected that foreign skill and technology reduce skill limit, investment reduces savings limit and foreign exchange limit equally. Since these gaps limit development, if they are closed, then there is development possibility. A country can increase its new capital formation or investment through its own domestic savings and inflow of capital from abroad. The inflow of foreign capital enables a country to spend more than it produces.

3.2 Model Specification

The model is specified below:

RGDP = f(FDI, INF, INT)……………………………………………………. (1)

RGDP = β0 + β1FDi + β2INF+ β3INT + Et……………………………. (2)

Where:

RGDP = Real Gross Domestic Product FDI = Foreign Direct Investment

INF = Inflation Rate INT= Real Interest Rate β0– constant term

β1β3 Coefficient of Independents variables Et Stochastic Error term or residual

3.3 Apriori Expectation

The Apriori expectation provides expected signs and significance of the value of the coefficient of the model parameters to be estimated in light of economic theory and empirical evidence. The coefficient of the foreign direct investment is expected to be positive (β1>0) which shows that a positive foreign direct investment gears economic growth. The coefficient of the inflation rate is also expected to be negative (β2<0) which shows that as the inflation rate increases there is a decrease in economic growth. The coefficient of real interest rate is expected to be negative (β3<0) which shows that an

increase in interest rate will make the cost of borrowing more expensive, this reduces investment and make a consumer switch to more savings, the effect is a decrease in economic growth. (Jean, 2019).

3.4 Nature And Sources Of Data

The data employed in this study are secondary, the study employed annual times series data. The data span the period of 19902017. The data series was adopted from the CBN statistical bulletin and World Bank development indicators.

3.5 Measurementof Variables

The dependent variable RGDP was used to proxy economic growth and it was measured with real Gross Domestic Product in Nigeria for the period under investigation. The independent variables included in the model are:

- Foreign Direct Investment: It is investment that comes from abroad. FDI will get to countries that pay higher return on capital. A higher GDP implies a brighter prospect for FDI in Nigeria. Since FDI comes into a country to enable it have a better economy, it would boost the RGDP.

- Inflation Rate: It is the increase in overall price level of an economy, usually as measured by the Consumer Price Index (CPI) or by the implicit price deflator.

- Real Interest Rate: it is the lending interest rate adjusted for inflation as measured by the GDP deflator.

3.6 Estimation Techniques

This study shall adopt the econometrics tool which is developed for the measurement of economic relationships. This method implies the use of a mathematical and statistical tool in analyzing economic phenomena. It gives a quantitative or numerical expression to economic theory. This is accomplished by expressing economic relationships in mathematical form and applying the method of statistical inference to the measurement of economic relationships. (Koutsoyiannis, 1977). The trend analysis will be employed; this study also employs the ordinary least square method of analysis techniques (OLS) in determining and analyzing the relationship between the variables of the model.

4. Data Analysis And Interpretation

This chapter entails the estimation and results of the empirical investigation carried out. It entails the correlation matrix and the descriptive analysis which shows the measure of central tendency which include the mean, median as good measures of variation, it also takes into consideration the trend analysis which shows the trend of the time series data used from 19902017 and econometric analysis which focuses on granger casualty and the OLS regression analysis.

4.1 Preliminary Results

4.1.1 Descriptive Statistics

Table 1 reveals the overview of the data collected and the summary of preliminary analysis showing the mean, standard deviation, skewness and peakedness of the variables employed for analyzing the relationship between foreign direct investment and economic growth in Nigeria.

Table 1. Descriptive statistics of the data set

| GDP | INF | INT | FDI | |

| Mean | 3.84E+13 | 18.68666 | 2.262550 | 3.42E+09 |

| Median | 3.34E+13 | 12.54679 | 5.867386 | 1.98E+09 |

| Maximum | 6.90E+13 | 72.83550 | 25.28227 | 8.84E+09 |

| Minimum | 1.92E+13 | 5.382224 | 43.57266 | 5.88E+08 |

| Std. Dev. | 1.84E+13 | 17.42604 | 17.29437 | 2.63E+09 |

| Skewness | 0.485976 | 1.962300 | 1.225334 | 0.733198 |

| Kurtosis | 1.689159 | 5.655049 | 4.277839 | 2.226485 |

| JarqueBera | 3.106826 | 26.19373 | 8.911756 | 3.206753 |

| Probability | 0.211525 | 0.000002 | 0.011610 | 0.201216 |

| Sum | 1.07E+15 | 523.2266 | 63.35139 | 9.57E+10 |

| Sum Sq. Dev. | 9.17E+27 | 8199.006 | 8075.571 | 1.86E+20 |

| Observations | 28 | 28 | 28 | 28 |

Source: Author’s computation, (2019).

The table above portrays the measures of central tendencies (mean and median) of all the observations in the data set lie within the maximum and minimum values indicating the high tendency of the normal distribution. The standard deviation of the variables; GDP, INF, INT, FDI is 38.3tn, 18.68, 2.26 and 3.42bn respectively. GDP, INF and FDI are skewed to the right which implies that these three variables are positively skewed, however, INT is skewed to the left since it is negatively skewed. The kurtosis statistics reveals that GDP and FDI are platykurtic since their value are less than three, while INF and INT are leptokurtic since their kurtosis statistics are greater than three. The probability value of GDP and FDI is less than 0.05 which implies that they are not normally distributed, while the pvalue of INF and INT is greater than 0.05, this can be said to be normally distributed.

4.1.2. Correlation Matrix

Table 2. Correlation matrix of the variables

| GDP | FDI | INF | INT | |

| GDP | 1.000000 | 0.716738 | 0.410433 | 0.183630 |

| FDI | 0.716738 | 1.000000 | 0.339611 | 0.114433 |

| INF | 0.410433 | 0.339611 | 1.000000 | 0.541907 |

| INT | 0.183630 | 0.114433 | 0.541907 | 1.000000 |

Source: Author’s computation (2019).

The table above is used to present the numerical values of the relationship that exists between GDP, FDI, INF and INT. it can be deduced that GDP and FDI possesses a high positive correlation, GDP and INF has a weak negative correlation, while GDP and INT possesses a poor positive correlation, INF and FDI has a weak negative relationship, INF and INT has a moderate negative correlation, lastly INT and FDI has a poor positive relationship. A.A, Adesoye & E. O, Maku (2013). However, some authors argued that when the correlation between the variables is greater than 0.95, then there is a high tendency for multicollinearity and this can lead to a spurious result (Alin, 2010; Chong & Jun 2005; Jesshim, 2003; Mansfield & Helms, 1982; Olofin et al., 2014; Paul, 2008), but the table above indicates that there is no multicollinearity among the variables as the correlation between the variables is below 0.95.

Note that, the correlation should not be seen as causality. This is because the correlation between two totally unrelated series could be strong while causality between the same variables may be nonexistent.

4.2 Trend Analysis

The trend points out the upward or downward direction of the time series over a period. This section shows the general directional pattern which could be increasing or decreasing in which the series data of foreign direct investment and gross domestic product appear to be moving over the period of 28 years.

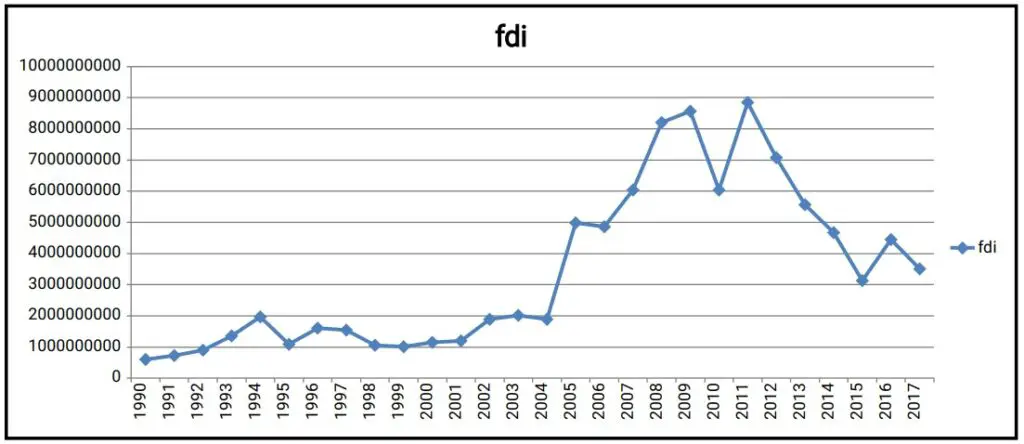

Source: Author’s Computation (Microsoft Excel), 2019.

Fig 1: Trends in Foreign Direct Investment (19902017)

From the figure above, FDI increases and fluctuate slightly from the year 1990 to 2004. Foreign investors looking for exposure to Nigerian bonds need to consider the country’s credit rating. Credit ratings are fluid and can change from year to year, from the year 2005 to 2009 the rate of inward FDI increased due to factors like strengthened backward linkages from FDI into the indigenous economy, foreign direct investments remain a major source of industrial growth and development as well as a major source of technology transfer. However, it was decreasing from the year 20112015 since the economy was no longer favourable to foreign investors. The figure above indicates that FDI was at its peak in the year 2011.

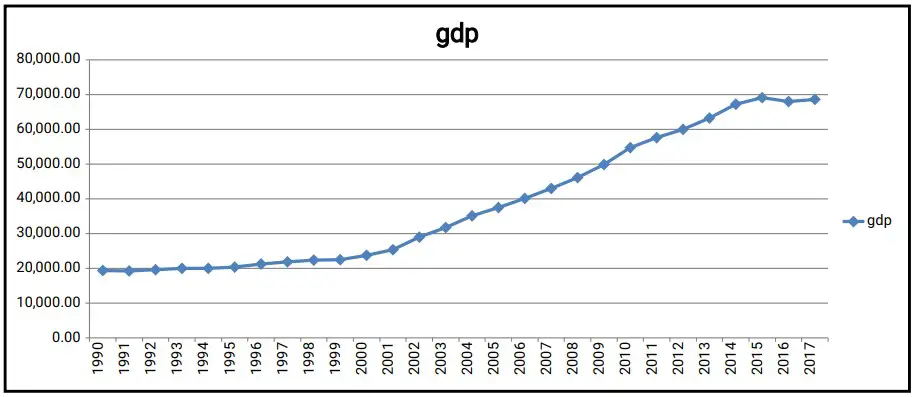

Source: Author’s Computation (Microsoft Excel), 2019.

Fig 2: Trends in gross domestic product

The figure above shows that economic growth as proxy real GDP has been increasing over the period of 28 years, from 1990 to 1999 GDP grows at a lower rate, while it grows faster from the year 2000 to 2015. From the figure real GDP has its peak in

Dependent Variable: LOG(GDP)

Method: Least Squares

Date: 08/17/19 Time: 13:48

Sample: 1990 2017

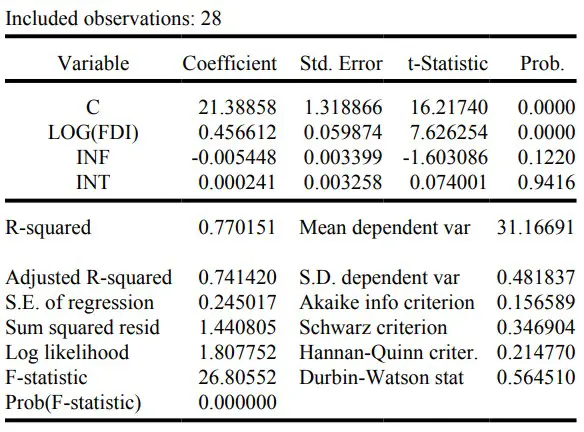

4.3 Regression Analysis

(GDP) = β0 + β1(FDI) + β2(INF) + β3(INT) + U

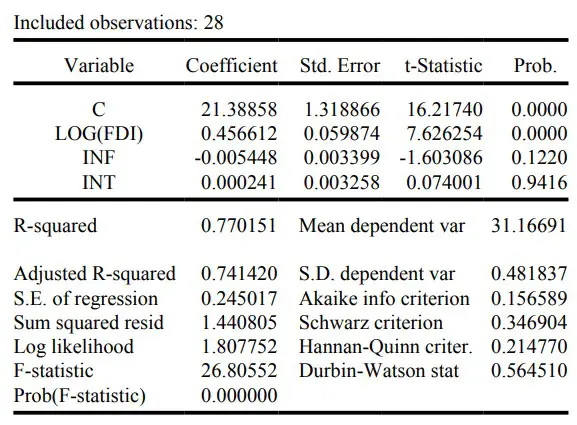

Table 3: Regression

Source: Author’s Computation (Eview 9), 2019.

The log of GDP and FDI were taken because their data were given in value terms, unlike INF and INT that were in percentage.

LOG (GDP) = β0 + β1LOG(FDI) + β2(INF) + β3(INT) + U

The regression equation becomes

LOG (GDP) = 21.3886 + 0.4566LOG(FDI) 0.0054(INF) + 0.0002(INT) + U

Findings:

The constant parameter value 21.38858 shows the value of GDP if FDI, INF and INT are not given. The value of Durbin Watson 0.564510 implies the presence of positive autocorrelation. The Rsquare suggest that the model has high goodness of fit.

Foreign direct investment and economic growth

The coefficient of foreign direct investment (β1) is positive; this shows a positive relationship between real GDP and FDI, from the above result, a one percent increase in FDI will increase real GDP by 0.456612percent and viceversa; this aligns with the apriori expectation.

Inflation rate and economic growth

The coefficient of inflation rate (β2) is negative, this depicts an inverse relationship that exists between real GDP and inflation rate, therefore a one per cent increase in the inflation rate will reduce real GDP by 0.005448 and viceversa, this aligns with the apriori expectation.

Real interest rate and economic growth

The coefficient of real interest rate (β3) is positive; this shows a positive relationship between real GDP and real interest rate, the result shows that one percent increase in interest rate will increase real GDP by 0.0002410 percent and viceversa, this is not in line with the apriori expectation.

The Adjusted R2 value

This is a measure of the degree of association between three or more variables. It measures the strength of the degree of linear association between three or more variables. The adjusted R2 value of 0.741420 (74.14%) implies that FDI, INF, INT account for about 74 percent of changes that can occur in economic growth for the period of years under study.

The remaining 26 % unexplained variation is taken by the error term.

4.3.1 Evaluation base on Apriori Expectation

The test aims to determine whether the signs and sizes of the results are in line with what economic theory postulates. This table is below.

Apriori Expectation

The test aims to determine whether the signs and sizes of the results are in line with what economic theory postulates. This table explains below.

Table 4: Apriori expectation and obtained table

| Variables | Expected sign | Obtained sign | Remark |

| FDI | + | + | conform |

| INF | | | conform |

| INT | | + | unconform |

Source: author’s computation (2019).

From the apriori expectation, it is observed that all the variables actually conform to the economic postulates or criteria. The coefficient of interest rate does not conform with apriori expectation.

4.3.2 Evaluation based on statistical criteria

The Student’s Test:

H0: The individual parameters are not significant.

H1: The individual parameters are significant

If Tcalculated > Ttabulated, we reject the null hypothesis {H0} and accept the

alternative hypothesis {H1}, and if otherwise, we select the null hypothesis {H0} and reject the alternative hypothesis {H1}.

Level of significance = α at 5% = 0.025

Where N: Sample size. =28

K: Number of parameters =3

Degree of freedom= N-K, (28-3) = 25

Table 5: T test table

| Variables | |tcal| | |ttab| | Remark |

| FDI | 7.626254 | 2.060 | significant |

| INF | 1.603086 | 2.060 | insignificant |

| INT | 0.074001 | 2.060 | insignificant |

Source: Author’s computation (2019).

Tstatistics which is used to test for individual significance of the estimated

parameters {β1β3}. It shows that all the parameters are statistically insignificant except for foreign direct investment i.e. the critical value = 7.626254 is greater than tabulated; 2.060. This means that only foreign direct investment is individually statistical significant at a 5% (0.05) level of significance.

F-Statistics

The Ftest is used to test for the overall significance of the model and to test the hypothesis that all the estimated parameters are simultaneously equal to zero. At a 5% level of significance, the Ftabulated (F0.05) is given as 3.39. Since F*cal (26.80552) is greater than the F*tab (3.39), we reject Ho and conclude that the estimated parameters are significantly different from zero. This is further corroborated by the probability value of FStatistic (0.000000) which is relatively lower than the 5% critical level.

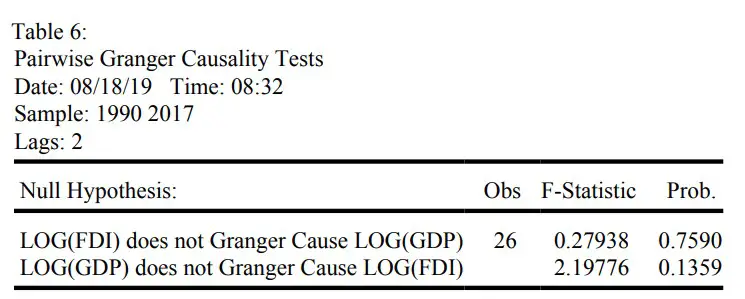

4.4 Granger Causality Test

Source: Author’s Computation (Eview 9), 2019

The result from the granger causality test reveals that foreign direct investment and economic growth does not granger causes each other, since none of the probability value is less than 0.05.

4.5 General Discussion

The broad objective of this study is to investigate the impact of foreign direct investment on Nigeria’s economic growth for the period of 28 years (19902017). The study takes into consideration the preliminary test such as descriptive statistics and correlation matrix, the trend analysis which shows the trend of the time series data used, and econometric analysis which comprises of granger casualty and the OLS regression analysis. The correlation matrix indicates that there is no multicollinearity among the variables as the correlation between the variables is below 0.95. And also correlation should not be seen as causality. This is because the correlation between two totally unrelated series could be strong while causality between the same variables may be non existent.

The regression model has economic growth represented as real GDP to be the dependent variable, and it is explained by foreign direct investment, inflation rate and real interest rate, the result proves that the model is statistically significant at 5% level, the model has high goodness of fit as shown by the value of Rsquare, a positive autocorrelation also occur in the model as shown by the durbinwatson statistic. a positive relationship exists between real GDP and real interest rate, a positive relationship also exist between real GDP and FDI, an inverse relationship exist between real GDP and inflation rate, the result also shows that inflation rate and interest rare parameters are statistical insignificant while foreign direct investment is statistically significant.

The positive effect of FDI on economic growth aligns with the research work carried out by Muntah, Khan, Haider and Ahmad (2015); Koojaroenprasit (2012); Melnyk et al (2014); Otto et al (2014); Ayanwale (2007) and Roman et al (2012), Who all found that FDI has a positive effect on economic growth. However, the finding of this study is contrary to that of Aitken et al (1999) and JyunYi et al (2008) who found a negative effect of FDI on economic growth. The result from the granger causality test reveals that foreign direct investment and economic growth does not granger causes each other.

5. Summary, Conclusion And Recommendations

This chapter discusses the summary conclusion and some policy recommendations. It is divided into three subsections. The first section discusses the summary of the study while the second section concludes the study; the last section presents the policy recommendations.

5.1 Summary

The study examines an analysis of the Impact of Foreign Direct Investment on Nigeria’s economic growth over the period of 28 years. The findings revealed that economic growth is directly related to the inflow of Foreign Direct Investment, the study employs the OLS regression analysis using an annual time series data of 19902017. The regression model has economic growth represented as real GDP to be the dependent variable, and it is explained by foreign direct investment, inflation rate and real interest rate, the result proves that the model is statistically significant at 5% level, the model has high goodness of fit as shown by the value of Rsquare The result reveals that FDI has a significant positive effect on economic growth, The positive effect of FDI on economic growth aligns with the research work carried out by Muntah, Khan, Haider and Ahmad (2015); Koojaroenprasit (2012). The result from the granger causality test reveals that foreign direct investment and economic growth does not granger causes each other.

5.2 Conclusion

The result of this study portrays that domestic investment was also responsible for the growth witnessed in Nigeria’s economy over the period under review. This provides an understanding that domestic investment is a major factor that contributes to the growth of the Nigerian economy. And so, more emphasis should be geared towards encouraging domestic investment to drive the economy to the desired level of growth. The government and the monetary authorities should design programs and policies that will encourage investors to invest in Nigeria.

5.3 Recommendations

In the light of the above findings, the followings, i.e. recommendations are proposed to encourage and improve the inflow of Foreign Direct Investment in Nigeria:

- Government should provide adequate infrastructure and policy framework that will be conducive for doing business in Nigeria, so as to attract the inflow of FDI.

- There is need for government to be formulating investment policies that will be favorable to local investors in order to complement the inflow of investment from abroad.

- Given the causal link among exchange rate – export growth economically at the Nigerian economy, favorable exchange rate policies should be formulated and implemented.

- This study also recommends an improvement in state infrastructure especially energy (power), ensuring sound, and stable macroeconomic environment, enthroning a stable social political environment among others. Furthermore, technological changes through knowledge spillover should be encouraged. This can take place through imitation, competition, linkage and training. If it can work in Asian Tiger countries, it can work well in Nigeria. We need to encourage and improve in it.

- Policies which would focus on the enhancement of the internal economy, especially the stability of the economy, should be pursued by Nigerian government.

- Regulators can undertake sustainability impact assessment and regulate microeconomic and local condition. This includes monitoring of benchmarks and business practice, voluntary guidelines, and transfer of environmentally sound technology. Regulation of investment is only as effective as a country’s ability to enforce it.

- Government should improve the investment climate for existing domestic and foreign investors through infrastructure development; the availability of power especially would go a long way because it would reduce the cost on alternative power supply. Provision of services and changes in the regulatory framework relaxing laws on profit repatriation will also encourage investors to increase their investments and also attract new investors.

- The problem of insecurities should be addressed squarely by the government and other stakeholders if Nigeria will continue to compete favorably in the globe fund market.

References

- Adelegan, J.O. 2000, Foreign Direct Investment and Economic Growth in Nigeria: Aseemingly unrelated model”. African Review of Money, Finance and Banking, Supplementary issue of “Savings and Development”, Milan, Italy, 5(25).