A Final Project on “Impact of Crude oil export on Economic Growth of Nigeria” was submitted by Olawale Mudashiru (from the University of Jos, Plateau State) to extrudesign.com.

1. INTRODUCTION

1.1 BACKGROUND OF THE STUDY

Nigeria economy is basically an open economy with international transactions constituting an important proportion of her aggregate economic activities. Over the years, the degree of openness of the economy has grown considerably. Before Nigeria gained its political independence in 1960, agriculture was the dominant sector in the economy, which provides both cash crops and food crops to the economy and accounted for the largest part of the foreign exchange of the country but, the discovery of crude oil production in commercial quantities changed the structure of the Nigerian economy. This led to the neglect of agricultural products, making the economy depend heavily on the production of crude oil. In 2000, oil and gas export accounted for more than 98% of export and about 83% of federal Government Revenue (Odularu, 2008).

Nigeria is a natural resource-abundant country. In particular, over the past fifty years, the country‟s oil subsector has grown phenomenally. Both production and exports have increased enormously since commercial production in 1958. For example, crude oil production increased from 395.7 million barrels in 1970 to 776.01 million barrels in 1998. The Figure increased to 919.3 million barrels in 2006. The Figure however decreased to 777.5 million barrels in 2009. In the same way, crude oil exports increased from 139.5 million barrels in 1966 to 807.7

million barrels in 1979. The volume of crude oil exports dropped to 390.5 million barrels in 1987 but increased to 675.3 million barrels in 1998. The trend continued for most years after 2000. In the same way, oil revenue increased from N166.6 million in 1970 to N 1,591,675.00 million and N6, 530,430.00 million in 2000 and 2008 respectively (Odularu, 2008).

The huge revenues from oil, of course, presented net wealth and thus provided an opportunity for increased expenditure and investment; however, the huge revenues complicated macroeconomic management and also made the economy highly oil-dependent. Asides, from the huge rents from oil, the economy still grapples with many problems including high and rising unemployment rate, declining manufacturing production, the high and rising levels of poverty and poor infrastructural development. The dismal performance of the Nigerian economy in the face of huge rents from oil has rekindled interest in the importance of oil in the growth and development process in Nigerian.

Mismanagement over the years hindered economic reforms from achieving their full economic potentials. However, Nigeria Gross Domestic Product at purchasing power parity became more than doubled from$170.7billion in 2005 to $374.3billion in 2010, with the informal sector putting the actual numbers greater than $374billion. The Gross Domestic Product per capita doubled from $1,200 per person in 2005 to an estimated $2,500 per person in 2009, with the informal sector included, the Gross Domestic Product per capita was estimated at around $3,500 per person. Furthermore, the United States remains Nigeria‟s largest customer for crude oil export accounting for 40% of the country total oil exports, providing about 10% of overall United States oil imports and ranked as the fifty-largest source for united States imported oil (Odularu, 2008).

1.2 STATEMENT OF THE PROBLEM.

Owing to both external and internal factors, the growth performance of the Nigerian economy has been less than satisfactory during the past three decades. Since the first oil price shock of 1974, oil has annually produced over 90% of Nigeria‟s export income from 1970 to 1999, oil generated almost $231 billion in rents for the Nigeria economy and these rents have constituted between 21% and 48% of Gross Domestic Product, but yet these rents have failed to raise Nigeria incomes and done little to reduce poverty. Since 1970, Nigeria‟s per capita income has fallen by about 4% in constant dollars. Also, since early 1970, the government has annually received over half of its revenues from the oil sector which is about 85%. These oil revenues are not only large but highly volatile and causing the size of government programs to fluctuate accordingly. From 1972 to 1975, government spending rose from 8.4% to 22.6% of GDP, by 1978, it dropped back to 14.2% of the economy. This fluctuation has made the government unable to adhere to wise fiscal policies during the 1970s and 1980s, when oil prices fluctuated sharply, the ability of these governments to spend their funds wisely, and limit corruption has been low. Although large proceeds are obtained from the domestic sales and export of petroleum products, its effect on the growth of the Nigerian economy as regards returns and productivity is still questionable, hence there is a need to evaluate the relative impact of oil export on economic growth in Nigeria.

1.3 OBJECTIVES OF THE STUDY.

With the development of petroleum in the Nigerian economy, there has arisen a growing concern and interest of many researchers towards its impacts on economic growth. Since crude oil is one of the major factors that affect economic growth, the objectives of this study are however spelt out into two, i.e. general objective and specific objectives. The general objective of this study is to examine the impact of oil export on economic growth in Nigeria. While the specific objectives are:

- To examine the relationship between oil export growth and economic growth.

- To find out if fluctuations in oil export also causes a fluctuation in economic growth.

- To make recommendations based on the findings.

1.4 SIGNIFICANCE OF THE STUDY.

The study will be beneficial to the following:-

- It will be relevant to oil companies operating in Nigeria in many of their operational and investment decisions.

- It will equally, serve as source of information for policy makers and stakeholders in the industry.

- It will also, guide the government and its agencies in regulating the industry.

- The study will, as well, be helpful to the general public and anyone who might be interested in the oil sector.

- The study will add more literature to the existing ones on this topic, hence; future researchers will benefit immensely from the work.

1.5 HYPOTHESIS OF THE STUDY.

This study is designed to investigate the impact of oil export on economic growth in Nigeria. The hypothesis to be tested under this study is the null hypothesis ( and the alternate hypothesis ( ), where the null hypothesis is the hypothesis of no significant difference while the alternate hypothesis is the hypothesis of significant difference. The hypothesis is therefore postulated as follow:

H0: There is no statistically significant relationship between oil export and economic growth in Nigeria.

H1: There is a statistically significant relationship between oil export and economic growth in Nigeria.

1.6 SUMMARY OF RESEARCH METHODOLOGY.

To obtain reasonably dependable results, all sources of information must be such that truly reflect the subject matter. In this research work, the econometric technique used is ordinary least square (OLS) in form of multiple linear regressions. The data used are purely obtained from secondary sources which are deemed fit for this research. The sources of data are Central Bank of Nigeria Statistical Bulletins (CBN), 2013 and NNPC Annual Statistical Bulletin (ASB, 2013).

APRIORI EXPECTATION

The apriori expectation is that a positive relationship seems to exist between Real Gross Domestic Product and Crude oil export as well as crude oil production

i.e. coefficient of crude oil export and crude oil production will be greater than zero (0). Therefore, the expectation for the variables is that an increase in the independent variables ( and ) will equally lead to an increase in the dependent variable (Y).

1.7 SCOPE OF THE STUDY

The research work is going to be based on the Nigerian economy. The scope of the study will cover most of the review that has to do with crude oil export in Nigeria which major details will cover the period between 2000 –2013

1.8 ORGANISATION OF THE STUDY.

This research work has been divided into five chapters as follows: Chapter one which is the general introduction of the entire study comprises the statement of the problem, objectives of the study, significance of the study, the hypothesis of the study, methodology, scope of the study and organization of the study. Chapter two is the literature review, which covers conceptual, theoretical and empirical literature. Chapter three consists of the research methodology which shows the model formulation, estimation, evaluation, justifications and limitations of the research work. Chapter four presents the data and show the analysis and interpretation of findings which as well as hypothesis testing and discussion of results. Chapter five which is the last chapter deals with the summary of findings, conclusions and recommendations.

REFERENCES

- Odularu, .G.O (2008), “Crude oil and Nigerian Economic Performance”. Central Bank of Nigeria (2013). Statistical Bulletin. CBN, NIGERIA.

- Nigerian National Petroleum Corporation (2013). Annual Statistical Bulletin. NNPC, Nigeria.

2. LITERATURE REVIEW

2.1 CONCEPTUAL LITERATURE

2.1.1 CONCEPT OF CRUDE OIL

Petroleum or crude oil is any naturally occurring flammable mixture of hydrocarbons found in geologic formations, such as rock strata. Most petroleum is a fossil fuel, formed from the action of intense pressure and heat on buried dead zooplankton and algae. Technically, the term petroleum only refers to crude oil, but sometimes it is applied to describe any solid, liquid or gaseous hydrocarbons. Although it is often called “black gold,” crude oil has ranging viscosity and can vary in colour to various shades of black and yellow depending on its hydrocarbon composition. Distillation, the process by which oil is heated and separated in different components, is the first stage in refining (Anne, 2004).

The name petroleum covers both naturally occurring unprocessed crude oil and petroleum products that are made up of refined crude oil. A fossil fuel, petroleum is formed when large quantities of dead organisms, usually zooplankton and algae, are buried underneath sedimentary rock and subjected to intense heat and pressure. Petroleum is recovered mostly through oil drilling (natural petroleum springs are rare). This comes after the studies of structural geology (at the reservoir scale), sedimentary basin analysis and reservoir characterization (mainly in terms of the porosity and permeability of geologic reservoir structures) (Guerriero, 2012). It is refined and separated, most easily by distillation into a large number of consumer products, from gasoline (petrol) and kerosene to asphalt and chemical reagents used to make plastics and pharmaceuticals (Maugeri, 2005).

The name petroleum covers both naturally occurring unprocessed crude oil and petroleum products that are made up of refined crude oil. Crude oil varies greatly in appearance depending on its composition. It is usually black or dark brown (although it may be yellowish, reddish, or even greenish). In the reservoir, it is usually found in association with natural gas, which being lighter forms a gas cap over the petroleum, and saline water which, being heavier than most forms of crude oil, generally sinks beneath it (Vassiliou, 2009). Crude oil may also be found in semi-solid form mixed with sand and water, as in the Athabasca oil sands in Canada, where it is usually referred to as crude bitumen. In Canada, bitumen is considered a sticky, black, tar-like form of crude oil that is so thick and heavy that it must be heated or diluted before it will flow (Speight and James, 1999).

2.1.2 Concept of Economic Growth

The concept of economic growth may be viewed in terms of the total physical output or real income of an economy. Also, it could be referred to as an increase in real output or per capital output of an economy. The definition correctly recognizes that the standard of living of the people in any economy is best measured in terms of real output per person. The standard of living could decline in an economy if the population increased at a faster rate than the volume of the real output. It is therefore a steady process by which the productive capacity of the economy is increased over time to bring about a rising level of national income (Kuznet, 1973).

Economic growth must be maintained if a nation is to improve the standard of living of the people. Economic growth is therefore defined and measured in two ways. Especially, economic growth may be defined as follows; – As the increase in real GNP which occur over a period of time. Economic growth by either definition is usually calculated in terms of the annual percentage rate of growth. For example, if the real GNP of Nigeria was #200billion last year and #210b this year, we can calculate the rate of growth by subtracting last year‟s GNP from this year‟s GNP (# 210b – # 200b) = 1 /20 or 5%. Therefore, economic growth can be seen from the example above, as an increase in a country‟s productive capacity, as measured by comparing gross national product (GNP) in a year with the GNP in the previous year (Ahmed, 1989 ).

From this point, one can observe that economic growth usually refers to the quantitative increase in the total or per capita output of goods and services in an economy whereas development implies a positive change in the social, institutional and other structural relationship within which growth takes place. For growth to take place that is for future output to be greater than the present output it is necessary to increase the existing level of productive capacity i.e. the available stock of capital goods. But this can happen only if part of the current output is withheld from present consumption (i.e. saved) and used to add to the existing stock of capital goods is what is called investment. We can see therefore that growth is not possible without the savings-investment process.

Economic Growth is conventionally measured as the rate of increase in Gross Domestic Product (GDP). According to Elhanah (2004), Growth is usually calculated in real terms (netting out the effect of inflation on the price of the goods and services product).

According to Dwivedi (2004), economic growth is a sustained increase in per capita national output or net national product over a long period of time. It implies that the rate of increase in total output must be greater than the rate of population growth. Another quantification of economic growth is that national output should be composed of such goods and services which satisfy the maximum want of the maximum number of people. However, economic growth can be determined by four important determinants namely, human resources, natural resources, capital formation and technological development.

2.2 A REVIEW OF RELATED THEORIES

2.2.1 Export and Economic Growth

The relationship between export performance and economic growth is an area that has been given much attention by development economists. This has broadly classified economists into two: i.e. those that support the hypothesis that export growth has a positive impact on economic growth and those that reject the hypothesis that there is no positive impact on economic growth. Awokuse, (2008) argued that an increase in foreign demand for domestic exportable products can cause an overall growth in output via increase employment and income in the exportable sectors, therefore, exports are the engine of growth.

According to Balassa (1978), exports can provide foreign exchange which is critical to imports capital and intermediate goods that in turn raise capital formation beneficial for meeting expansion of domestic production and thus stimulate output growth. According to Helpman and Krugman (1985), international trade promotes specialization in the production of export products which in turn boosts the productivity level and causes the general level of skills to rise in the export sector.

According to Feder and Edwards (1992), export leads to the reallocation of resources from the inefficient non-trade sector to the trade sector and dissemination of the new management styles and production techniques through the whole economy. To Giles and Williams (2000), the entire economy would benefit due to the dynamic spillover of the export sector growth. Chenery and Strout (1996), postulated that an increase in exports improves the balance of payment and enlarges the foreign monetary reserves, which enables the increase of investment goods import and facilities necessary for the domestic production growth.

Jung and marshal (1985), argue that growth in real exports tends to cause growth in the real gross national product (GNP) for three reasons: first, export growth may represent an increase in the demand for the country‟s output and thus serve to increase real GNP. Second, an increase in exports may loosen a binding foreign exchange constraint and allow increases in productivity intermediate imports and hence result in the growth of output. Third, export growth may result in enhanced efficiency and thus may lead to greater output.

2.2.2. Export-Led Economic Growth.

The notion of trade as an engine of growth is given much emphasis by many economists. The idea that international trade brings economic growth increases the welfare of a nation started during the 17th century by a group of merchants, government officials and philosophers who advocated an economic philosophy known as mercantilism. For a nation to become powerful, it has to export more than it imports where the resulting export surplus is used to purchase precious metals like gold and silver. The government in its power has control of imports and stimulates the nation‟s exports.

Adam Smith attacked the main mercantilist‟s views and proposed the classical theory of international trade based on the concept of absolute advantage model. According to him, the stock of human, man-made and natural resources rather than the stock of precious metals was the true wealth of a nation and argued that the wealth of a nation can be expanded if the government would abandon mercantilist controls. In addition, he showed that trade can make a nation better off without making another worse off (Debel, 2002).

A model of comparative advantage was later articulated by David Ricardo to replace the principle of absolute advantage. According to this model, a country will specialize in the production of the commodity which it‟s had in abundant and export the commodity i.e. the commodity that it can produce at the lowest relative cost.

Also, J.S. Mill formulated a theory, the principle of reciprocal demand and later developed by Edgeworth and Marshall. Both demand and supply conditions determine the terms of trade and hence trade between countries.

The proponents of the traditional theory of trade argued that trade can contribute largely to the development of primary exporting countries. However, other economists strongly believe that the accrual of the gains from international trade is biased in favour of the advanced industrial countries and that foreign trade has inhibited industrial development in poor nations. These economists contend that international trade has been irrelevant for developing nations and the development process.

There are two policies adopted by many developing countries namely, import substitution and export promotion. Proponents of the view that trade brings development policies encourage outward-looking development policies (Export promotion). According to Todaro (1994), the outward-looking development policies “encourage not only free trade but also free movement of capital, workers, enterprises and students, the multinational enterprises, and open system of communication”.

In contrast, opponents of the traditional view advocate an inward-looking development policy. This policy stresses the need for less developed countries to implement their own styles of development and adopt indigenous technologies appropriate to their resource endowment.

The factor endowment theory of Eli (1919) and Berti (1933), of external trade, evolved. According to this theory, different relative proportions and countries have different endowments of factors of production. Some countries have large amounts of capital (capital abundant) while others have little capital and much labour (labour abundant). This theory argued that each country has a comparative advantage in that commodity which uses the country‟s abundant factor. Capital abundant countries should specialize in the production and export of capital-intensive goods while labour abundant countries should specialize in the production and export of labour-intensive commodities. This theory encouraged third world countries to focus on their labour and land-intensive primary product exports.

However, it was argued that by exchanging these primary products for manufactured goods of the developed countries, third world nations could realize enormous benefits obtained from trade with the richer nations (Debel, 2002).

Export-led growth is important for mainly two reasons. The first is that export-led growth can create profit, allowing a country to balance their finances, as well as surpass their debts as long as the facilities and materials for the export exist. The second, the much more debatable reason is that increased export growth can trigger greater productivity, thus creating more exports in an upward spiral cycle.

2.2.3 Economic Growth Theory

Economic growth is generally regarded as a necessary component of any development strategy and given population growth, economic growth is necessary just to maintain the material quality of life at existing levels.

Harrod-Domar theory is used to explain economic growth which is the main essential feature of economically growing without a corresponding economic development. The theory shows that there is a positive relationship between saving and growth while there is a negative relationship between growth capital/output ratios. Growth can be mathematically expressed as G =s/k, where k=incremental capital-output, s = the average propensity to save.

Also, Solow‟s theory of economic growth shows that growth is based on output, i.e. the combination of labour and capital. When the input is doubled, then there will be an increase in production too. It can be mathematically written as y= f (l, k). Solow‟s growth model assumes that the marginal product of capital decreases with the amount of capital in the economy. In long run, when an economy accumulates more capital, the capital stock (g k) approaches zero and the growth rate is determined by technical progress and growth in the labour force. While in the short run, an economy that accumulates capital faster will enjoy a higher level of output.

Furthermore, the traditional neoclassical growth theory assumes that output growth occurs from three factors namely: first, increase in labour quality and quantity i.e. through population growth and education. Second, increase in capital

i.e. through saving and investment. Third, improvement in technology (Odularu, 2010).

2.3 EMPIRICAL LITERATURE

The contribution of export growth to economic growth has been tested by different economists using different econometric techniques.

Muhammad and Sampata (1997), investigate if there is clear proof that exports led to economic growth, through the use of granger (1969) causality, ADF is used to test for co-integration. The result shows unidirectional causality from exports to GDP with a positive relationship between the two variables is found.

Gemechu (2002), using cointegration and error correction approaches in the regression analysis examined the policies and test for the relationship between exports and economic growth. The result shows that export significantly affected economic growth in the short run. There is causality that runs from exports to economic growth.

Idowu (2005), used a causality approach to examine that there is a relationship between exports and economic growth in Nigeria. Using Johansens multivariate co-integration technique. The result shows that there is a stationary relationship between exports and gross domestic product (GDP). There is feedback causality between exports and economic growth.

Akanni (2007), examined if oil-exporting countries grow as their earnings on oil rents increases, using PC-GIVE10, (ordinary least squares regression). The result shows that there is a positive and significant relationship between investment and economic growth and but a negative insignificant relationship between oil rents and economic growth. In conclusion, oil rents in most rich oil developing countries in Africa do not promote economic growth.

Hadi, et al (2009), investigate the impact of income generated from oil exports on economic growth in Iran. Using the Cobb-Douglas production function, the economy of Iran adjusts fast to shocks and there is progress in technology in Iran. Oil exports contribute to real income through real capital accumulation.

Mohammed and Amirahi (2010), examines if factors such as oil price, world oil supply and demand, production capacities enhanced export growth in Iran using Error Correction Version of ARDL. It was found that there is an inverse relationship between oil products consumption and oil export revenues. Iran had significant positive growth in its oil revenues.

Odularu (2010), used Harrod-Domar theory and Solow‟s theory of economic growth as well as Cobb-Douglas production function was employed to test the impact of crude oil on Nigeria economic performance. The result shows that crude oil production contributed to economic growth but have no significant impact on the economic growth of Nigeria.

Khaled, et al (2010), tested if export enhanced economic growth in Libya Arab. Using co-integration with Granger causality. The results show that income, exports, and relative prices are cointegrated. It was concluded that both export and growth are related to each other.

Samad (2011) tested the hypothesis that there exists a relationship between exports and economic growth in Algeria. The Augmented Dickey-Fuller test was used to run the regression. The result shows that the variables are non-stationary. It was concluded that there is a causal relationship between economic growth, exports and imports.

Rahmaddi (2011), examine the exports and economic growth nexus in Indonesia employing the vector autoregressive (VAR) model. The findings indicate the significance of both exports and economic growth to the economy of Indonesia as indicated in the GIRF analysis. It was concluded that exports and economic growth exhibit a bidirectional causal structure, which is Export-Led Growth in the long run and Growth Led Export in the short run.

2.4 The Nature of Economic Growth in Nigeria

Kuznet (1973) has defined a country„s economic growth as “ a long term rise in capacity to supply increasingly diverse economic goods to its population, this growing capacity based on advancing technology and the institutional and ideological adjustments that it demands.” The production of goods and services is not possible without a sustainable increase in technological advancement. In fact, to realize the potential growth inherent in new technology, there is a need to make some institutional, attitudinal and ideological adjustments within the nations.

However, the nature of economic growth in Nigeria is generally poor. The standard of living in Nigeria is a tiny fraction of that in an industrialized nation. Nigeria as we know is among the developing countries of the world commonly characterized as the less developed countries (LDC).

Optimistically, a developing country is regarded as being capable of substantial improvement in its income level. However the growth rate in Nigeria is very low because productivity is low, incomes are low and in turn low savings. This means low capital formation and hence productivity becomes low. Nigeria cannot afford to devote a very large proportion of its production to capital goods, since it is hard to provide sustenance for massive production. The problem is intensified by the population growth of Nigeria as a result whatever saving and capital formulation does occur is barely sufficient to keep the capital and labour ratio from falling (Kuznet, 1973).

According to the law of diminishing returns, this means that unless there is better technology, an increase in the quality of labour or improvement in the quality or quantity of other inputs per worker will not rise. Thus, Nigeria is caught in a vicious circle of poverty. Being poor, Nigeria has little ability or incentive to save. Furthermore, low income means a low level of demand. As a result, there are few available resources, on one hand, and no strong incentive on the other hand for investment in real or human capital, labour productivity is therefore low. And since output per person is the real income per person, it follows that per capita income is low; thus resulting in a very low standard of living, which is manifested quantitatively and qualitatively in the form of low income (poverty), inadequate housing, poor health, limited or no education, high death rate and in fact mortality, low life expectancy and in many cases a general sense of malaise and helplessness (Maugeri, 2006).

More also, there is inadequate income distribution in Nigeria, which is to say that there is a growing gap between the income of the rich and the poor people within the economy. The problems between the rich and the poor people in Nigeria will determine the degree of poverty. The more unequal the distribution of income, goods and services, the greater the incidence of poverty. Also, the lower the average income level, the greater the incidence of poverty, thus this is an overview of the nature of Nigeria economic growth.

2.5 Nigeria’s Exports Performance.

Nigeria‟s economy was mainly an agrarian economy in which the major parts of its foreign exchange comes from the sales of cash crops such as cocoa, groundnut, coffee, cotton, solid minerals and palm produce. Due to the oil boom of the 1970s, crude oil then took over from agriculture as the major foreign exchange earner to the country it to 96.8%, while by 2000; it got to 99% (Kareem, 2004).

However, the share of non-oil exports in total exports declined from 7.0% in the period 1970-1985 to about 4 between 1986 and 1988. The decline recorded in the non-oil export was due to the problems being encountered by the agricultural sector which was worsened by inappropriate pricing policies, and the death of farm labour caused by rural-urban migration, as well as infrastructural inadequate in the rural areas. The government made efforts to restore the non-oil sector of the economy during the structural Adjustment Programme era. Despite all the measures that were put in place, the performance of the non-oil export sector has remained encouraging as crude oil remains major in Nigeria‟s export.

Furthermore, the trends of the structure of the Nigerian economy as reflected in her trade exports makes it unlikely that the country will be able to take the advantage of increased liberalization and openness of the economy to achieve trade induced growth. The border of the country had been thrown open since the independence in 1960 with a 32% level of openness, which later rose to 48% in 1977 during the import substitution era. It got to 68% in 1992 during the Structural Adjustment Programme period and later increased to its peak of 92% in 2000 due to the oil imports and exports.

However, exports positively contribute to economic growth through various ways:

- An increase in exports could promote specialization in the production of export commodities that in turn may increase the productivity of the export sector.

- Export expansion may result in efficient resource allocation since it brings incentives for domestic resource allocation closer to international opportunity costs.

- Exports that are based on comparative advantage would allow the exploitation of economies of scale that are external in the non-export sector, but internal to the overall economy.

- Exports expansion benefitted from international market also allows greater capacity utilization exploiting increasing foreign demand in world markets.

- Export may also give access to advanced technological improvement in the economy due to foreign market competition.

REFERENCES

- Adedipe. B. (2004), “The Impact of Oil on Nigeria‟s Economic Policy Formulation”.

- Akanni, O.P (2004) “Oil Wealth and Economic Growth in Oil Exporting African countries”.

- AERC Research paper 170.

- Answer .S.M, R.K. Sampath (1997) “Exports and Economic Growth” Presented at Western

- Agricultural Economics Association Annual meeting. July.

- Debel .G. (2002), “Exports and Economic Growth in Ethiopia”. An Empirical Investigation.

- Elbeydi and etal (2010), “The relationship between Export and Economic Growth in Libya

- Arab Jamairiya”.Theoretical and Applied Economics, vol. xv11,No.1(542), pp. 67-76.

- Esfahani K., M.H Pesaran (2009) “Oil Exports and the Iranian Economy”. IZA Discussion

- paper No. 4537 October.

- Odularu, .G.O (2008), “Crude oil and Nigerian Economic Performance”.

- Odularu, .G.O., C. Okonkwo, (2009), “Does Energy Consumption Contribute to the

- Economic Performance?” Empirical Evidence from Nigeria.

- Rahmadi .R. (2011) “Exports and Economic Growth in Indonesian”A causality approach

- based on Multi-Vitiate Error Correction Model.Journal of International Development and Cooperation, vol.17, No.2, pp.53-73.

- Samad .A. (2011) “Exploring Exports and Economic Growth Causality in Algeria”. Journal

- of Economic and Behavioural Studies, Vol. 2. No 3, Pp, 92 – 96. March.

3. RESEARCH METHODOLOGY

3.1 MODEL FORMULATION

The research study will employ multiple regression equation methods of analysis to enable us to establish a relationship between the dependent variable and the independent variables of the research model. Lee (1999) opined that in regression analysis and other related fields such as econometrics, formulation or specification is the process of converting a theory into a regression model.

For this study, the proxy for economic growth in Real Gross Domestic Product while the proxies for crude oil are: crude oil export and oil revenue. Real Gross Domestic Product is therefore specified as a function of crude oil export and oil revenue. RGDP is used as a measure of GDP because it takes care of inflation and there is easy access to RGDP data in Nigeria. This can be written as

RGDP = f (EX, CRP);

Where,

- RGDP = Real Gross Domestic Product

- EX = Crude oil Export

- CRP =Crude Oil Production

The dependent variable is Real Gross Domestic Product and the independent variables are Crude oil Export and Oil Revenue. Ceteris Paribus, the a priori expectation is that a positive relationship seems to exist between Real GrossDomestic Product and Crude oil export as well as crude oil production i.e. coefficient of crude oil export and oil revenue will be greater than zero (0). Hence, the functional form of the model that will be used here is formulated thus:

Y = a + β1 X1 + β2X2 + μi)

where

- Y = real Gross Domestic Product

- a = intercept of the model

- β1 = Cofficient of crude oil export

- X1 = crude oil export

- β2 = Cofficient of crude oil production

- X2 = crude oil production

- μi = Disturbance term (error term)

The disturbance or error term (μi ) represent other determinants that cause a change in the dependent variable (Y) other than independent variables (Xi) in a model (Koutsoyiannis, 2003). Therefore, the error term represents determinants of economic growth other than crude oil (Xj) in which the model of the research study did not capture appropriately.

3.2 MODEL ESTIMATION

The next step of this research is a model estimation. After the model has been formulated, it is paramount to proceed with its estimation to obtain the numerical estimates of the coefficients of the model (Koutsoyiannis, 2003). This also will enable us to ascertain the degree of correlation between the explanatory variables and the dependent variable of the model.

However, to estimate the parameters a, β1 and β2, multiple linear equations will be used. It should be well-known that the estimation of these parameters will be based on the assumption of the Ordinary Least Square method of analysis which holds that;

- E (μi) = 0, the random variable has a zero (0) mean value for each Xi.

- E (μi, μj) =0, where i ≠ j Non-autocorrelation or serial independence of the μ’s, the value of μi is independent from the values of any other μj.

- Explanatory variables are not multi-collinear.

- E (X, μ) =0, independence of μi and Xi. Every disturbance term, is independent of the explanatory variables (X).

- N ~ N (0, δ ) normality of , i.e. the values μ of are normally distributed.

- E (μi2)= δ (costant) the variables of each μi is the same for all the values (Koutsoyiannis, 2003).

The model that will be used in this research will enable the researcher to estimate the relationship that exists between the economic growth of Nigeria and crude oil export, and in the end, the researcher will be able to draw valid conclusions. For this research study, economic growth is the dependent variable (Y) while crude oil is the independent variable (X). However, because the research study will employ a multiple regression method of analysis, two (2) independent or explained variables will be considered. These are, and, where,

X1 = crude oil export (a proxy for crude oil) and

X2 = crude oil production which is the second variable.

From the model, therefore, a, β1 and β2 will be estimated to evaluate the statistical reliability of the parameters. The a priori expectation for the variables is that an increase in the independent variables (X1 and X2) will equally lead to an increase in the dependent variable (Y).

3.3 MODEL EVALUATION

The third important phase of this research methodology consists of the evaluation of the model. After the estimation of the model parameters, the regression results must then be evaluated to test the significance of the estimates. This is essential to know the statistical reliability of the parameters estimates (Koutsoyiannis, 2003). The evaluation consists of deciding whether the estimated parameters are both theoretically meaningful and statistically satisfactory.

The procedures test to be considered under the model evaluation in this research work includes:

- Test of Goodness Fit (R2)

- Adjusted coefficient of determination (r= √R2)

- Standard Error Test

- T- statistic Test

- F- statistic Test

- Durbin Watson Test (DW)

3.3.1 Test of Goodness of Fit (R2)

After estimating the parameters and the determination of the least square regression line, we need to know how „good‟ is the fit of this line to the sample observation of Y and X, that is to say, we need to measure the dispersion of observations around the line (Koutsoyiannis, 2003). This is important because of the closer the observations to the line, the better the goodness of fit, i.e. the better the explanation of the variations of the dependent variable (Y) by the changes in the explanatory variables ( ).

The coefficient of the determination gives the overall strength of association between the dependent variable (Y) and the independent variables (Xi). The value of R2 is between 0 and 1, and the higher the R2 the better the “goodness of fit” of the regression plane to the sample observation, and the closer to zero (0), the worse the fit (Koutsoyiannis, 2003). This implies that a higher value of R2, but less than 1 implies that, the regression equation has a very high explanatory power and that the regression line is a „good fit‟ (Dwivedi, 2003).

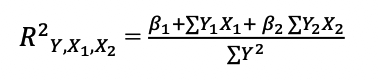

The coefficient of multiple determination is given as:

3.3.2 Adjusted Coefficient of Determination (r = √R2)

The adjusted coefficient of determination or the coefficient of correlation is the square root of the coefficient of determination which is employed to correct

undue magnification as more variables are introduced into the model. This can be denoted by r i.e. r = √R2.

It further measures the degree of association between the dependent variable and the independent variables. Therefore, the adjusted coefficient of determination indicates the magnitude/nature of correlation or relationship that exists between the dependent variable and the independent variables.

3.3.3 Standard Error Test

The standard error test enables us to decide whether the parameter estimates of a, β1 and β2 are statistically significant or different from zero (0). Since a, β1 and β2 are sample estimates of the parameters, we must therefore test their statistical reliability using different tests. This test also helps us to establish the degree of confidence in the validity of the estimates. The standard error test is written as S.

Decision Rule

If the standard error of the parameter estimates is greater than half of the parameter estimates, we accept the null hypothesis and conclude that our parameter estimate is statistically insignificant, otherwise, we reject the null hypothesis and conclude that our parameter estimates are statistically significant.

3.3.4 T- Statistic Test

We use the T-statistic to test the hypothesis at a 5% level of significance with an N-K degree of freedom. This test tells us whether the degree of variation in the dependent variable is associated with regression on the independent variable. If the value of the scaling term in the T-statistic were known and is replaced by an estimated based on the data, the test statistic follows a student T-distribution. This is because the distribution corresponds to different sample sizes (that is usually below 30).

Decision Rule

If t-calculated is greater than t-tabulated, we reject the null hypothesis and say that our parameter estimates are statistically significant. Otherwise, we accept the null hypothesis and conclude that our parameter estimates are insignificant.

3.3.5 F – Statistic Test

This is used to test the overall reliability of the model at a 5% level of significance. It is the test of the stability of the regression coefficient. That is, whether the parameter estimates will remain stable over time. The F –test is also called the Analysis of Variance (ANOVA). Both analyses of variance and regression analysis have as their objective, the determination of the various factors which cause variations of the dependent variable, and this resemblance has led to the combination of the two methods in most scientific fields (Koutsoyiannis, 2003).

The F –test aimed at finding out whether the explanatory variables (X1 and X2 ) actually have any significant influence on the dependent variable (Y). This can be done by testing the null hypothesis (H0) against the alternate hypothesis (H1).

Decision Rule

If Fcalc> Fα, we reject the null hypothesis i.e. we accept that the overall regression is significant, not all β‟s is zero. On the other hand, if Fcalc< Fα, we accept the null hypothesis, i.e. we accept that the overall regression is not significant.

3.3.6 Durbin Watson Test (DW)

This test is used to test the presence of autocorrelation in a research model. The autocorrelation arises when the value of the error term in any period is correlated with the preceding value (Koutsoyiannis, 2003). Autocorrelation also refers to the relationship, not between two or more different variables, but between the successive values of the same variable. The presence of autocorrelation in a model renders the Ordinary Least Square (OLS) inconsistent.

Decision Rule

If dcalc=2, we accept the null hypothesis and conclude that there is no autocorrelation in the function. If 0< dcalc<2, we reject the null hypothesis and conclude that there is some degree of positive autocorrelation which is stronger than the value of dcalc.

3.4 JUSTIFICATION OF THE METHODOLOGY

In this research work, the econometric technique used is ordinary least square (OLS) in form of multiple linear regressions. However, the reasons for the choice of method include;

- The computational procedures are fairly simple and not complicated as compared with other econometricstechniques.

- The method is simple to calculate and results obtained are reliable.

- The method have been used in a wide range of economic relationships with fairly satisfactory results beenyielded.

- Due to the nature of the data to be used being secondary, it makes it easy to establish a valid relationship between the dependent variable and the independent variables.

- The method of Ordinary Least Square (OLS) is easy and simple to understand, and besides most other econometrics techniques involves components of OLS- method (Gujarati and Sangeetha, 2007).

3.5 LIMITATION OF THE METHODOLOGY

Secondary data are processed data that originate from raw data. Secondary data is the major source of data generation for this work, and it is important to note the problems or limitations associated with it even though they were dealt with precisely.

One of the limitations of this method of study is model misspecification. Model misspecification can substantially affect the significance level of a statistical test. When a model is not specified appropriately, the entire research may fail to provide a correct answer to the investigation.

Again, poor data record keeping is a great challenge in the process of data generation in the country. In most cases, data of the same nature are usually at variance from different sources, i.e. this made the data obtained vary from source to source.

Hence, finding accurate and reliable data for specified models of this research is another limitation as they are not only inadequate but also unavailable. That is, the method of research cannot be accurate when reliable data are not available. Therefore, to ensure statistical reliability of the research, a lot of resources (e.g. time) and care are needed to unravel or arrive at accurate data that will fit into the research model and best efforts were made to verify the accuracy of the data obtained and hence would be utilized.

REFERENCES

- Dwivedi, D.N. (2003). Managerial Economics. Vikas Publishing House PVT Ltd; 6th Edition.

- Gujarati, D. and Sangeetha. (2007). Basic Econometrics, New York: Tata McGrahill. 4th Edition.

- Koutsoyiannis, A. (2003). An Introductory Exposition of Econometrics Methods.

- Theory of Econometrics, Palgrave Publishers Ltd. 2nd Edition.

4. DATA PRESENTATION AND ANALYSIS

4.1 DATA PRESENTATION

Time series data used for the estimation which covers the period of 2000 – 2013, were obtained from the Central Bank of Nigeria statistical bulletin (CBN, 2013) and the NNPC Annual statistical bulletin (ASB, 2013). Here, relevant data to this research study are presented and references are made base on the hypothesis tested in the introductory chapter. In this chapter, the research adopts a quantitative research method, specifically the use of the linear multiple regression model, which has the benefits of predicting and explaining economic phenomena with several explanatory variables (Gujarati, 2006).

In this aspect, we the relationship between crude oil and the economic growth of Nigeria. Using data on oil export and crude oil production as proxies for crude oil and real gross domestic product as a proxy for economic growth and this data spanned a period of fourteen (14 years) which were subjected to econometric test using E-views software based on which informed conclusion will be drawn.

Earlier in this study, a theoretical analysis of the impact of crude oil on Nigerian economic growth has been made and the relationship suggests that crude oil positively influence economic growth. Thus, a quantitative analysis of these theoretical postulates is made.

Table 4.1 shows the Real Gross Domestic Product as a dependent variable represented with (Y) which is regressed on the explanatory variables (crude oil export and crude oil production), represented with and respectively.

| YEAR | RGDPN(Million) Y | CRUDE OIL EXPORT N(Million) X1 | CRUDE OIL PRODUCTION (Million b/day) X2 |

| 2000 | 329,178.60 | 1,920,900.40 | 828,547,638 |

| 2001 | 356,994.30 | 1,973,222.20 | 865,173,583 |

| 2002 | 433,203.50 | 1,649,445.80 | 740,687,180 |

| 2003 | 477,533.00 | 2,993,110.10 | 844,150,929 |

| 2004 | 527,576.00 | 4,489,472.20 | 910,156,486 |

| 2005 | 561,931.40 | 7,140,578.92 | 918,660,619 |

| 2006 | 595,821.60 | 7,191,085.54 | 869,196,506 |

| 2007 | 634,251.30 | 8,110,500.38 | 803,000,708 |

| 2008 | 672,202.50 | 9,659,772.56 | 768,745,932 |

| 2009 | 717,036.40 | 8,543,361.19 | 780,347,940 |

| 2010 | 782,341.40 | 8,382,112.10 | 896,043,406 |

| 2011 | 798,256.80 | 8,428,328.00 | 866,245,232 |

| 2012 | 799,325.80 | 9,992,224.00 | 852,776,653 |

| 2013 | 810,215.90 | 11,112,258.90 | 800,488,096 |

4.2 MODEL SPECIFICATION

As indicated in the previous chapter, RGDP is a function of crude oil export and crude oil production. That is,

Y = f ( X1,X2 ) and thus, Y = a + β1 X1 + β2X2 + μ Or

RGDP = a + β1 OILEX + β2CRP + μ

Where;

- Y = real Gross Domestic Product

- a = intercept (autonomous) term

- β1 = slope of crude oil export

- X1 = crude oil export

- β2 = slope of crude oil production

- X2 = crude oil production

- μ = Disturbance term (error term)

4.3 MODEL ESTIMATION

For this study, the aid of statistical software (E-views) is used because the process of estimating manually is complex, cumbersome and tedious. We use linear specification: (Y = a + β1 X1 + β2X2 + μi) to examine the impact of crude oil on economic growth in Nigeria.

Ceteris paribus, our a priori expectation is that the parameter estimate of Real Gross Domestic Product is directly related to crude oil export and crude oil production. By implication, an increase in crude oil export and crude oil production will considerably increase the RGDP. This means that the signs of β1 and β2 are expected to be positive. Since Y = a + β1 X1 + β2X2 + μi , Therefore, a = Y – β1 X1 – β2X2 – μi

Where;

a = 215857.2

β1 = 0.047336

β2 = 9.694058

Source: regression result from E-views software

Therefore, Y = 215857.2 + 0.047336 X1 + 9.694058 X2 + μi

The following results are obtained from our regression and presented in the table below

TABLE 4.2

Dependent Variable: RGDP

Method: Least Squares

Date: 09/28:44

Sample: 2000 2013

Included observations: 14

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| OILEX | 0.047336 | 0.005412 | 8.746573 | 0.0000 |

| CRP | 9.694058 | 0.000327 | 0.296022 | 0.7727 |

| C | 215857.2 | 278304.2 | 0.775616 | 0.4543 |

| R-squared | 0.874303 | Mean dependent var | 606847.8 |

| Adjusted R-squared | 0.851449 | S.D. dependent var | 165907.8 |

| S.E. of regression | 63944.68 | Akaike info criterion | 25.15683 |

| Sum squared resid | 4.50E+10 | Schwarz criterion | 25.29377 |

| Log-likelihood | -173.0978 | F-statistic | 38.25605 |

| Durbin-Watson stat | 0.967746 | Prob(F-statistic) | 0.000011 |

4.4 MODEL EVALUATION

Having obtained the parameter estimates, there is the need to test the significance of the estimates. This enables us to know the statistical reliability of the estimates

4.4.1 Coefficient of Multiple Determination (R2)

This enables us to determine precisely the exact extent to which the total variation in Y (Real Gross Domestic Product) is explained by the independent variables X1 and X2 (crude oil export and crude oil production). It is used in determining the explanatory power of X1 and X2 on Y using the ordinary least square (OLS) method.

Therefore, from the multiple regression of our model, we obtain the value of R2 as 0.874303 or 87.4%. this implies that 87.4% variation in the real gross domestic product is due to the variation in crude oil export and crude oil production (X1 and X2), while the remaining 12.6% of the variation is due to the disturbance term (i.e. unexplainable term). This implies that the regression line gives a good fit to the observed data.

4.4.2 Coefficient of Correlation (Adjusted )

The inclusion of an additional explanatory variable say ( X2) raises the coefficient of multiple determinations. To correct this defect, we adjust R2 taking into account the degree of freedom which clearly decreases as a new regressor is introduced in the function (Koutsoyiannis, 1997).

The coefficient of correlation however helps to measure the degree of association between the explanatory variables (X1 and X2) and the dependent variable (Y). the value of adjusted R2 in our analysis is 0.851449, which indicates that there is a strong positive linear correlation between the dependent variable real gross domestic product (Y) and the independent variables (crude oil export and crude oil production) in Nigeria, therefore the variables are highly correlated because the value of adjusted is greater than 0.5 or 50%.

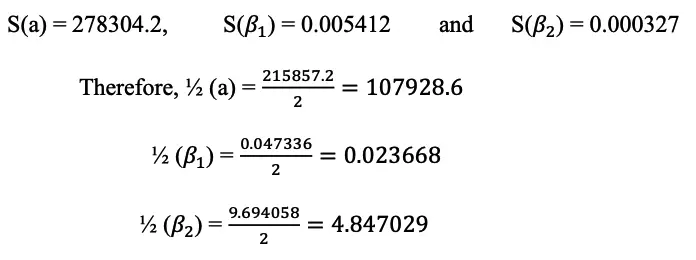

4.4.3 Standard Error Test

Since sampling errors are inevitable in all estimates, it is necessary to apply the test of significance to measure the size of error and to determine the degree of confidence in the validity of our estimates (Koutsoyiannis, 1997)

For this research study, the standard error test which is popular in applied econometrics tests is used. The test helps us to determine whether the estimates a, β1 and β2 are significantly different from zero i.e. whether the sample from which they have been estimated might have come from the population whose true parameters are zero (a, β1 and β2 =0).

From our computation in table 4.2, we obtained the following results for our standard error:

Thus, since S(a) =278304.2 and ½ (a) = 107928.6, it shows that S(a) > ½ (a), we accept the null hypothesis ( H0: a =0) at a 5% level of significance and we conclude that the least square is statistically insignificant and not different from zero.

Again, the test of significance for crude oil export in Nigeria (X1) showed that, S(β1) < ½(β1) ( i.e. 0.005412 < 0.023668, we, therefore, reject the null hypothesis (H0) which is equivalent to accepting that the true parameter (β1) is different from zero and conclude that the parameter estimate for crude oil export (β1) is statistically significant.

And finally, the test of significance for crude oil production in Nigeria revealed that, S(β2) < ½ (β2) i.e. 0.000327< 4.847029, we reject the null hypothesis (H0) at a 5% level of significance and conclude that the parameter estimate for crude oil production (β2) is different from zero and statistically significant.

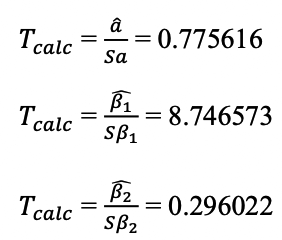

4.4.4 The Student T-Test

The t-statistic test examines whether the degree of variation in the dependent variable is associated with the regression on the independent variables ( and ). Using the t-statistic to test the hypothesis:

H0: a, β1 and β2 = 0 (statistically insignificant)

H0: a, β1 and β2 ≠ 0 (statistically significant)

The computed T-test from the regression result obtained are given below:

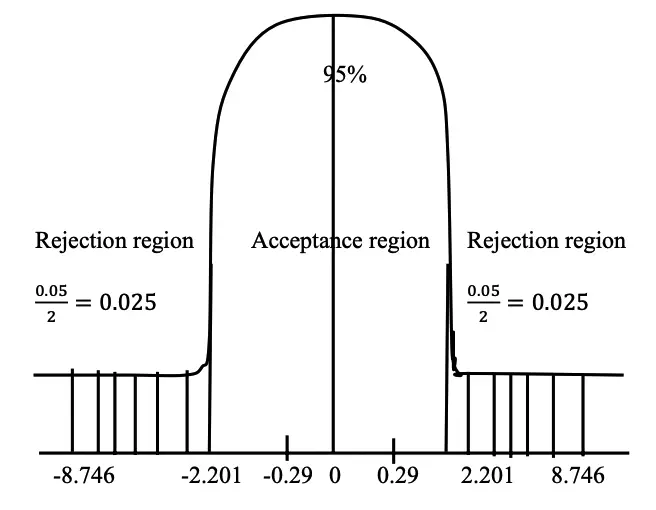

The degree of freedom is N-K, where N is several observations and K is several parameters, which is 14-3 =11. T-test at 5% level of significance two-tailed test is given as 0.05/2 = 0.025

Thus, T0.025 = 2.201(See appendix I)

T-test for the intercept (a)

Tcacl = 0.775676

Therefore, we compare our t-calculated (Tcacl) with the theoretical (Tα).

Thus, since the Tcacl<Tα i.e. 0.775616<2.201, we accept the null hypothesis and conclude that (a) is not different from zero and is statistically insignificant.

T-test for (crude oil export)

Tcacl = 8.746573

Therefore, since Tcacl>Tα i.e. 8.746573 > 2.201, we reject the null hypothesis and conclude that (β1) is different from zero and statistically significant.

T-test for (crude oil production)

Tcacl = 0.296022

Therefore, since Tcacl<Tα i.e. 0.296022<2.201, we accept the null hypothesis and say that ( i.e. crude oil production is not different from zero and is statistically insignificant. This is however in line with the apriori expectation and empirical evidence as reviewed in the previous chapter.

4.4.5 The F-Test

The F-test is used to test the overall significance of a regression (Koutsoyiannis, 1997). The test aims at finding out whether the explanatory variables ( X1 and X2 ) do have any significant influence on the dependent variable (Y). Formally, the test of the overall significance of the regression implies testing the null hypothesis.

H0: a, β1 and β2 = 0 (i.e. there is no significant relationship between crude oil and Economic Growth in Nigeria).

Against the alternative hypothesis

H0: a, β1 and β2 ≠ 0 (i.e. there is a significant relationship between crude oil and Economic Growth in Nigeria).

From the computation in table 4.2, F-statistic is obtained as = 38.25605. We compare the theoretical value of F at 5% level of significance with

V1 = K-1 and = N-K which is the degree of freedom. Thus, and V1 = 3-1 =2

V2 =14-3 = 11

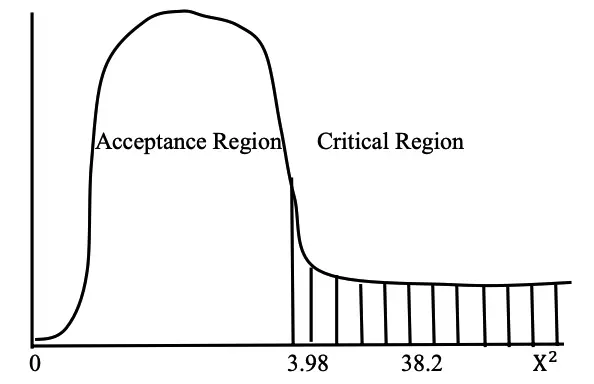

Fα or F0.05 = 3.98 (see appendix II)

From figure 4.2 above, our Fcacl>Fα thus falls outside the acceptance region (shaded area). Therefore, we reject the null hypothesis in favour of the alternate hypothesis. Thus, X1 and X2 are significant explanatory variables of the variation in Y.

4.4.6 Test of Autocorrelation (Durbin Watson Test)

Autocorrelation refers to the relationship, not between two or more different variables, but between the successive values of the same variable (Koutsoyiannis, 1997). The test may be outlined as follows:

The null hypothesis is H0: P = 0 (the υ‟s are not correlated) Against

The alternative hypothesis: H0 : P≠ 0 (the υ‟s are correlated)

From our computation in table 4.2, the result for Durbin Watson is obtained as: =0.967746

Therefore, from our computation 0< dcacl<2 i.e. 0<0.967746<2, we reject the null hypothesis and conclude that there exist some degree of positive correlation which also means that there is inconclusive evidence regarding the presence or absence of first-order serial correlation. We, therefore, conclude that the DW result is indeterminate.

4.5 INTERPRETATION OF RESULTS

Our result shows that the value of a, which is intercept and autonomous is positive i.e. 215857.2. this means that if the independent variables (X1 and X2 ), that is, crude oil export and crude oil production are held constant or assigned zero (0)value, the dependent variable (Y) will be as high as 215857.2.but immediately after the crude oil export start declining in Nigeria, the Real Gross Domestic Product will decrease in accordance as well as in the same direction (direct relationship) because β1 and β2 are both positive.

And also, from the result obtained, the coefficient for crude oil export in Nigeria (X1) is positive (0.047336). This clearly indicates that there seems to be a direct relationship between Real Gross Domestic Product and crude oil export in Nigeria. Therefore, the direct relationship conforms to our apriori expectation that the coefficient X1 will be positive. Also, the coefficient of crude oil production (X2) is positive (9.694058). This also shows the existence of a direct relationship with Real Gross Domestic Product which also conforms to the apriori expectation.

For the determination of stability and reliability of the parameter estimates (a, β1 and β2); the study employed the use of t-test statistics at a 5% level of significance. The result showed that „a‟ is statistically insignificant since tcacl< tα i.e. 0.775616 < 2.201 and its falls in the acceptance region. The parameter estimates for is statistically significant since tcacl> tα i.e. 8.746573>2.201. We, therefore, conclude that the activities of crude oil export significantly affect Real Gross Domestic Product in Nigeria. But, the parameter estimate β1 is statistically insignificant since tcacl< tα i.e. 0.29602 < 2.201, we state that crude oil production has no significant impact on the Real Gross domestic product.

The coefficient of multiple determination (R2) is used to test the explanatory power of the independent variables, on the dependent variable. The value of (R2) is found to be 0.874303; this implies that about 87.4% of the total variation in the dependent variable (Y) is explained by the independent variables (X1 and X2 ) of the model while the remaining 12.6% is due to error term (µ). This is to say that crude oil export and crude oil production explained about 87.4% variation in Real Gross Domestic Product in Nigeria; while 12.6% is accounted for by other factors such as agriculture, mining, the industry as well as government policies in the economy. The coefficient of correlation (adjusted ) is normally employed to test the degree of correlation between the independent variables ( and ) of a model. The value of adjusted from the egression result is 0.851449. This means that there is a strong positive correlation between the explanatory variables.

The F-test was tested at a 5% level of significance to test the reliability and stability of the parameter estimates of the model. The calculated F-test, that is, Fcacl which was obtained from the regression result with the help of E-view statistical software is 38.25605 while the tabulated F (Fα) = 3.98, since Fcacl >Fα, i.e. 38.25605 > 3.98, we reject the null hypothesis and say that the coefficient of the parameter estimates is stable and reliable statistically over time. Therefore, the explanatory variables are good predictors of the dependent variable which implies that the model has a good fit since Fcacl >Fα. From the analysis of the result, we may say that crude oil has a significant impact on the economic growth of Nigeria. It, therefore, becomes necessary for the government to keep strengthening the activities that revolve around crude oil production and exportation by channelling both her efforts and resources towards the development of the oil sector.

The standard error test was equally carried out under this research study; the result showed that the estimated parameter for the intercept is statistically insignificant in the model and not different from zero. This is because S ( ̂a) > ½ a; that is 278304.2 > 107928.6. Also, the parameter estimates for β1 and β2 are both statistically significant and reliable since S ( ̂β1) < ½ β1; i.e. 0.005412 < 0.023668 and S(β2) < ½ β2 ; i.e. 0.000327<4.847029.

The Durbin Watson test was at the same time carried out in this research work. The test enables us to know if there is autocorrelation in the model. According to the result obtained, it was deduced that the Durbin Watson test (DW) is 0.967746, that is, 0<DW<2. We reject the null hypothesis, this simply means that data used in this research work is not free from autocorrelation and there is inconclusive evidence regarding the presence or absence of positive first-order serial correlation.

Therefore, from the above analysis, the research revealed that there exists a positive relationship between crude oil and the economic growth of Nigeria, which is by our apriori expectation of the research and conformity to both theoretical and empirical review.

4.6 DISCUISSION OF RESEARCH FINDINGS

As the findings indicate, the improvement of the oil sector has a positive impact on the overall economic growth in Nigeria. It shows that the value of „a‟ which is intercept and autonomous is 215857.2, i.e. when ̂ and ̂ are constants, the value of the Real Gross Domestic Product will be 215857.2.

The research equally revealed that there is a strong positive relationship between crude oil export and crude oil production to Real Gross Domestic Product in Nigeria. This is however in line with our apriori expectation. This also implies that a unit change in Real Gross Domestic Product is influenced by a more than 1 (one) unit increase in crude oil export. This means that oil sector development induces economic growth.

This is consistent and following the study conducted by some scholars. For example, Krugman (1985) and Boomstrom (1986), argue that international trade promotes specialization in the production of export products which in turn boosts productivity and causes the general skills level to rise in the export sector.

Jung and Marshal (1985), argue that growth in real export tends to cause growth in the real gross national product (GNP) for three reasons:

- Export growth may present an increase in the demand for the country‟s output and thus serve to increase real GNP.

- An increase in exports may loosen a binding exchange constraint and allow increases in productivity, intermediate imports and hence results in growth of output.

- Export growth may result in enhanced efficiency, and thus may lead to greater output.

Also, according to Odularu (2008), oil production contributed to economic growth but have no significant impact on economic growth in Nigeria, this finding conform to the result analyzed above by the student t-test.

By and large, in our research findings, the standard error test shows that the parameter estimates ̂ and ̂ are statistically significant at a 5% level of significance. Whereas, the student t-test revealed that the intercept and parameter estimate ̂ are statistically insignificant at a 5% level of significance, except for parameter estimate ̂ which is statistically reliable and significant.

The result of our F-statistic shows that, the regression equation has a strong “Goodness of Fit” and therefore, we conclude that the overall regression analysis is emphatically valid. That is, both crude oil export and crude oil production have a significant influence on Real Gross Domestic Product. Finally, the result obtained for the Durbin Watson test implies that there is a positive relationship between the successive values of the same variables.

4.7 POLICY IMPLICATION

The findings from the regression result as presented and analyzed are indeed revealing. Considering the explanatory power of the model, it is obvious that the major factors or determinants of the impact of crude oil on the economic growth in Nigeria are crude oil export and crude oil production. This research however reveals that crude oil production and export are necessary for the improvement of Real Gross Domestic Product. Therefore, there is a need to strengthen the oil sector to keep the pace of economic growth steady without fluctuation.

Appropriate policy measures should be put in place by the federal government of Nigeria to check the bottleneck or fluctuations often experience in the oil sector and increase the flow of funds to the oil sector.

REFERENCES

- Central Bank of Nigeria (2013). Statistical Bulletin. CBN, Nigeria.

- Gujarati, D.N. (1995). Basic Econometrics. 3rd Ed New York: McGraw Hill, Inc. Jung, W.S. and P.J., Marshal, (1985), “Export, Growth and Causality in

- Development Countries,” Journal of Development Economics.

- Koutsoyiannis, A. (1997). Theory of Econometric. Hongkong Macmillan Education

- Books Limited. London.

- Nigerian National Petroleum Corporation (2013). Anuual Statistical Bulletin.

- NNPC, Nigeria.

- Odularu, G.O. (2008), “Crude oil and Economic Performance”.

5. SUMMARY, RECOMMENDATIONS AND CONCLUSION

5.1 SUMMARY

The study concentrated on the impact of crude oil on economic growth in Nigeria within the period of 2000 to 2013. A multiple regression analysis was employed to capture the influence of crude oil on RGDP and also determine the trend effect, that is, the effect of time as a variable. The results revealed a positive relationship between the variables. The conducted t-tests indicated that the explanatory variable i.e. oil production do not significantly affect Nigeria‟s economic growth. While the conducted f-test showed that the joint influence of the explanatory variables is significant, the text clearly indicates that 87.4% variation in RGDP can be explained by oil export and oil production which is a strong explanatory power of the model, while the total remaining 12.6% are determined by other variables outside the model such as the contribution of the agricultural sector, mining etc. There is about 85% degree of association between all the variables which indicate a strong relation.

5.2 RECOMMENDATIONS

Based on the findings of this research work, it is inevitable to provide a set of policy recommendations that would apply to the Nigerian economy:

- The Nigerian National petroleum corporation (NNPC) should diversify its export baskets through downstream production, this will enhance the refined petroleum for exports;

- The government should encourage more private company participation. So that better equipped refineries can be built and the cost of refining crude oil will reduce;

- Security should be boosted on the high sea where crude oil products are being smuggled. This will help reduce the loss from illegal export of crude oil products;

- Government should give immediate attention to the indigenes of the region where crude oil is being extracted from. This will reduce the unrest in that region;

- Government should establish an institution that will ensure that the multinational oil companies are socially responsible to their host community;

- There is a need to develop the agricultural sector side by side with the oil sector, the government need to develop agricultural sector which has been neglected over the years because oil is a wasting assets and too much reliance on oil to the neglect of agricultural is not of much benefit to the economy. Through this means, the industry sector will be modernized through the transfer of resources from the agriculturalsector.

However, if these recommendations are considered, they will go a long way in the improvement of the petroleum sector and the Nigerian economy at large.

5.3 CONCLUSION

The oil industry is vital in Nigeria, its output via revenue generated from its export and production is generally agreed to be a catalyst to economic growth. Drawing from the empirical investigation into the impact of crude oil on economic growth in Nigeria using RGDP as the dependent variable and oil export and crude oil Production as independent variables from 2000 –2013, it emerged from the study that there is a significant relationship between oil export and RGDP while there is insignificant relationship between crude oil production and RGDP. In addition, there exists a positive relationship between oil exports, oil production and RGDP. Finally, oil export has a significant impact on economic growth in Nigeria.

The study proved that there has been, neglect of the people, abandonment of the agricultural and manufacturing sectors and a reasonable contribution to GDP, through variation in the trend. It is the opinion of the researcher that corruption in the Nigerian nation may have contributed immensely to the poor contribution of the oil sector to the economic growth of Nigeria. For example, allegations abound where retired military officers and some influential politicians were offered oil licenses to lift and export crude oil and the proceeds are reflected in the private pockets of such people only.

In conclusion, crude oil accounted for significant percentages of the country‟s GDP and contributes largely to the value of Nigeria‟s export as well as enhance the country‟s productivity. Therefore, for increased performance of the oil sector, more and functional strategies and policies should be designed to ensure

effective implementation of programmes and meaningful projects. Note that the conclusion reached here has been based on statistical purposes. They must be weighed against real-life evidence and literary opinion.

BIBLIOGRAPHY

JOURNALS

- Jung, W.S., and P.J., Marshal, (1985), “Exports, Growth and Causality in Development Countries,” Journal of Development Economics.

- Odularu, .G.O., C. Okonkwo, (2009), “Does Energy Consumption Contribute to the Economic Performance?” Empirical Evidence from Nigeria.

- Rahmadi .R. (2011) “Exports and Economic Growth in Indonesian”A causality approach based on Multi-Vitiate Error Correction Model.Journal of International Development and Cooperation, vol.17, No.2, pp.53-73.

- Samad .A. (2011) “Exploring Exports and Economic Growth Causality in Algeria”. Journal of Economic and Behavioural Studies, Vol. 2. No 3, Pp, 92 – 96. March.

- Kuznet, S. (1973). “Modern Economic Growth: Findings and Reflections”, American Economic Review, American Economic Association, Vol. 63(3).

REFERENCE BOOKS

- Dwivedi, D.N. (2003). Managerial Economics. Vikas Publishing House PVT Ltd; 6th Edition.

- Elbeydi and etal (2010), “The relationship between Export and Economic Growth in Libya Arab Jamairiya”.Theoretical and Applied Economics, vol. xv11,No.1(542), pp. 67-76.

- Gujarati, D. and Sangeetha. (2007). Basic Econometrics, New York: Tata McGraw hill. 4th Edition.

- Gujarati, D.N.(1995). Basic Econometrics. 3rd Ed New York: McGraw Hill, Inc. Koutsoyiannis, A. (1997). Theory of Econometric. Hongkong Macmillan

- Education Books Limited. London

- Koutsoyiannis, A. (2003). An Introductory Exposition of Econometrics Methods.

- Theory of Econometrics, Palgrave Publishers Ltd. 2nd Edition.

- James, S.G. (1999). The Chemistry and Technology of Petroleum. 3rd Ed, revised

- CRC Press Vassilliou, M.S. (2009). Historical Dictionary of the Petroleum Industry. Scarecrow Press

GOVERNMENT PUBLICATIONS

- Central Bank of Nigeria (2013). Statistical Bulletin. CBN, NIGERIA.

- Nigerian National Petroleum Corporatiom (2013). Annual Statistical Bulletin.

- NNPC, Nigeria.

UNPUBLISHED MATERIALS AND PAPER PRESENTATION

- Adedipe. B. (2004), “The Impact of Oil on Nigeria‟s Economic Policy Formulation”.

- Akanni, O.P (2004) “Oil Wealth and Economic Growth in Oil Exporting African countries”. AERC Research paper 170.

- Answer .S.M, R.K. Sampath (1997) “Exports and Economic Growth” Presented at Western Agricultural Economics Association Annual meeting. July.

- Debel .G. (2002), “Exports and Economic Growth in Ethiopia”. An Empirical Investigation.

- Esfahani K., M.H Pesaran (2009) “Oil Exports and the Iranian Economy”. IZA Discussion paper No. 4537 October.

INTERNET MATERIALS

- Odularu, .G.O (2008), “Crude oil and Nigerian Economic Performance”. Retrieved from http://www.ogbus.ru/eng/.

Credit: This project “Impact of Crude oil export on Economic Growth of Nigeria” was prepared and submitted by Olawale Mudashiru from the University of Jos, Plateau State.

Leave a Reply