A final year project on “The Security Challenges Related To Electronic Banking Transactions” was submitted by Aditi Joshi (from Galgotias University Greater Noida, Uttar Pradesh) to extrudesign.com.

| University: | Galgotias University Greater Noida, Uttar Pradesh | |

| Project Title: | The Security Challenges Related To Electronic Banking Transactions | |

| Submitted by: | Adithi Joshi | |

| Authors: | Adiba Parveen, Aditi Joshi, and Tadiwanashe Glenn Chambre | |

| Supervised by: | Jyoti Nain, Assistant professor | |

| Department: | Bachelor in Business Administration | |

| Academic Year: | 2021-22 |

Abstract

E-Banking has come to be a critical component withinside the destiny improvement of the banking industry. Electronic banking or online banking is a carrier offered through many banks that permit managing of all varieties of banking business, basically over the net through the use of the statistics generation and communication. In many advanced nations E- banking performs a totally crucial position because of the reality that it’s the most inexpensive manner of presenting banking services. Beside this it additionally facilitated rapid motion of budget locally and throughout borders. It is a border much less entity allowing every time, everywhere and anyways banking to its clients. E-Banking is one of the maximum a success on line businesses, which store the money and time of clients and companies. It is without difficulty handy everywhere to a PC, PDA, cellular device, with a web connection. It additionally permits the customer to behaviour monetary transactions at the internet site of the institution, together with digital bank, retail bank, a credit score union etc. Despite of many blessings of E-Banking, there are a few elements which have an effect on its usage. This studies paper will introduce you to e-banking, giving the meaning, functions, types, benefits and issues. In quick e-banking is every time and everywhere banking

INTRODUCTION

Electronic Banking is greater normally known as internet banking or simply net banking. It is an digital charge gadget supported through a internet site that gives an array of services and products of any financial institution this is feasible to work electronically, like payments, transfers, deposits and greater. Use of computer systems and telecommunications to permit banking transactions to be completed through phone or pc in preference to via human interaction. Its capabilities consist of digital budget switch for retail purchases, computerized teller machines (ATMs), and automated payroll deposits and invoice payments. Some banks provide domestic banking, wherein someone with a non-public pc could make transactions, both through a right away connection or through gaining access to a Web site. Electronic banking has massively decreased the bodily switch of paper cash and coinage from one area to any other or maybe from one individual to any other.

REVIEW OF LITERATURE

The banking industry is on the forefront of adopting innovation, both to reduce the costs of bank operations and to improve services to customers. Raghavan (2006) opined that at present, more than 85% of the completed installment exchanges are an electronic and conventional method for doing saving money at the branch level has generally little significance to electronic keeping money clients. Many banks, including PSU banks, would have online ATMs, telephone saving money, virtual keeping money, e-saving money, Internet saving money, and so forth by 2020. Mohan (2006) commented that Indian saving money is at the edge of an outlook change and a huge improvement has been accomplished by banks in offering an assortment of new and inventive e-managing account administrations to clients today, which was not considered sometime recently. In any case, open segment banks have not possessed the capacity to tackle the advantages of computerization. Kamakodi et al (2008) found that a wide hole exists in human administration in Indian saving money while innovation based administrations are surpassing desires. Respondents opined that utilizing e-keeping money for adjusting request to be the most helpful, nearly taken after by between records exchange of assets and they discovered e-managing an account minimum valuable for hotel grievances. Moderate exchange speed was observed to be the most successive issue confronted, nearly taken after by non-accessibility of the server while utilizing e-saving money. Sharma (2009) opined that the pattern towards electronic conveyance of saving money items and administrations is happening somewhat therefore of buyer request, and mostly in light of the expanding aggressive condition in the worldwide setting. Kumar and Sinha (2009) referred to different cases of hacking and phishing assaults revealed all through India what’s more, Shukla (2011) expressed that E-saving money offers a more elevated amount of comfort for dealing with one’s accounts even from one’s room. In any case, it keeps on introducing difficulties to the money related security and individual protection. Clients are exhorted not to share individual data like PIN numbers, passwords and so forth with anybody, including workers of the bank; change ATM PIN and online login and exchange passwords all the time; guarantee that the signed in session is legitimately marked out. Mishra (2011) gave valuable tips to guarantee the security of IB exchanges. IB clients are prompted not to answer to any mail, telephone call or letter, requesting the IB data like login id or secret word, and not to tap on any connection given in any mail, guaranteeing to be the connection for the bank’s 29 May 2017, 31st International Academic Conference, site are the essential tips, among others. A survey of existing writing uncovers that however there is plenty of studies that inspected client’s discernment about e-saving money including its notoriety and issues, concentrates that analyzed the development of e-managing an account in India in volume and esteem terms are not found.

OBJECTIVES OF THE STUDY

The number one goal of the studies paper is to get the conversant of the net banking and its effect on conventional services. And to recognize the diverse dangers and protection demanding situations in E-banking.

RESEARCH METHODOLOGY

We use descriptive studies and exploratory studies layout in our research. Descriptive studies is likewise known as Statistical Research. The fundamental purpose of this kind of studies is to explain the records and traits approximately what’s being studied. The concept at the back of this type of studies is to observe frequencies, averages, and different statistical calculations. Descriptive studies is used to attain data regarding the cutting-edge repute of the phenomena to explain “what exists” with recognize to variables or situations in a situation. The methods involved range from the survey which describes the repute quo, the correlation observe which investigates the connection among variables, to developmental research which are looking for to decide modifications over time.

Data Collection

Primary Data: Structured Questionnaire

Secondary Data: Online Database Sampling:

The study’s goal became executed thru the gathering and evaluation of number one statistics received from a purposive sampling technique. Likert scale questionnaire became used to degree the belief of clients about e- banking. Members of the population are chosen based on their relative ease of access. To sample relatives, friends, businessman, bankers, govt. employees are all examples of convenience sampling

Products and Services Offered

To deal with the stress of developing opposition Indian industrial banks have used various initiatives and E-banking is one of them. The opposition has been especially tough for the public sector banks as the newly formed foreign banks and private sector banks are leaders in the adoption of E- banking. The Indian banks offered following E-banking products and services to their customers:-

- Automated Teller Machines [ATMs]

- Internet Banking (onlinesbi.com)

- Mobile Banking ( Bank apps )

- Tele Banking ( NUUP)

- Electronic Clearing Services

- Electronic Clearing Cards

- Smart Cards

- Doorstep Banking

- Electronic Fund transfer

The difficulties related to e-banking are examined beneath:

- Security Risk: Security troubles and different associated angles has end up one of the crucial issues for Banking location. Enormous volume of customers opposes taking up e-banking workplaces thinking about well being and protection concerns. As in step with the IAMAI Report (2006), 43% of internet customers are as but now no longer tolerating the usage of internet banking in India due to protection chances. Hence, it’s miles honestly tough for banks to steer the consumers in this angle, which may moreover elevate up the net banking usage.

- Security/Confidentiality risk: Risk of disclosure of now no longer to be found out or mystery facts and alert of wholesale fraud is one of the large motives that restrict the customers whilst choosing digital economic administrations. This is being familiar through sizeable no. of customers, that through taking up internet banking administrations, their man or woman could be at danger. As in step with the exploration, (Andrews S and Shen A., 2000) consumers worry linked with their safety withinside the way that financial institution may stroll into their secrecy through concerning their facts for selling and different large functions with out association of customers.

- The Trust Issue: Trust is the large snag to digital banking for a huge part of the customers. Conventional banking is regularly utilized by customers due to absence of conviction withinside the net primarily based totally financial institution exchanges. They have an mind-set that there may be a big gamble in internet primarily based totally economic trade prompting diverse cheats and tricks. While utilising net banking administrations through the customers, there typically remains an uncertainty or query to them with recognize to the fruitful completing of that trade until the time an confirmation message is gotten.

- Client Understanding: Knowledge or know-how with regard to e-banking amongst consumers approximately is presently at junior facet in Indian setting. Banks cannot sell entire facts approximately the usage, benefits and workplace of internet primarily based totally banking. Hence, one of the maximum ridiculously placed barriers withinside the improvement of digital banking is the much less readiness of latest improvements amongst customers.

- Less Internet dissemination in India: The internet primarily based totally economic channel has changed at some stage in the lengthy term. E-Banking use in India has delivered from 1% up in 2006 to 7% in 2011 whilst in North America withinside the yr 2011, 60 percentage of the instances essential exchanges in banks had been achieved thru net primarily based totally channels,( Infosys Report, 2012). Thus, it thoroughly can be reported that association and accessibility of internet is as but a one of the primary faces that exists in Indian setting. As indicated through the document of IAMAI 2006, round 22% of internet customers do not know approximately a way to pass reserves at the internet. In this way, the doorway of internet purchaser and statistics linked with internet are the large Challenges.

- Unfortunate Infrastructure: Internet Banking desires predictable assist of gifted basis for effective execution and prolonged geological reach. E-Banking has been managed to increase itself to semi metropolitan and rustic areas due to negative Infrastructural workplaces in wording of revolting installation, electric powered association, unlucky satellite, internet and broadband availability.

- Working Conditions: India is a state of diverse societies and several dialects but this makes running approach for net banking a chunk difficult as displaying Instructions or Guidelines in Different dialects is a clumsy task. In any case, innovation has discovered a solution for this, but, Illiterate people are as but now no longer protected below this association and moreover ATMs can’t make sure indistinguishable running tiers from all people bringing approximately excessive put on and tear.

- Illiteracy: In the occasion of Mobile Banking, the specialised tips and tips aren’t affordable through a bigger quantity of human beings of the transportable customers in decrease magnificence and resultantly, they locate them difficult to work. Buyers for the maximum component purchase Handsets in notion to their economic plan and people Handsets in a few instances provide the factors that are unsupportive, all matters taken into consideration and this becomes an obstacle withinside the execution of e-banking.

- Preparing the Employees: Training conferred to financial institution representatives is a extra honest errand if there have to rise up an prevalence of personal location banks, as they’ve younger effective PC gifted workers, whilst withinside the occasion of public location banks, making ready the representatives is a complicated task as gift group of workers is sort of lesser PC educated. Disregarding this reality, they’ve had the choice to do persuasively nicely next to running on it for north of 10 years at this point.

- Client Education: E-banking workplaces had been being made to be had to customers from early days if there have to rise up an prevalence of personal banks. Nonetheless, if there have to be an prevalence of vintage public location banks, it’s miles very tough to persuade their customers regarding the application of this program. Conferring Education amongst customers formally as for e-banking is difficult task. Taking under consideration this, banks decided on giving cash associated promptings like a Free Debit card, Free Net Banking workplaces, giving regular and opportune facts to customers with recognize to Monthly Statement in their facts on E-Mail, and so forth, to extrade customers to those growing administrations of banking.

- Confined Business: Another check for e-banking is that every one the economic exchanges cannot be achieved at the internet or thru different digital mediums; for few administrations like shops and withdrawals, one desires to transport closer to Banks genuinely. In spite of the truth that, it’s been visible that a part of the banks have robotized their method and their customers (the front end) but on the equal time diverse observe traditional interaction (returned end). This in a way limits the customers due to confined mindfulness and specialised barriers.

- Cost of Technology: Initial Cost of project is excessive as a ways as fee of PCs and distinctive equipments anticipated to play out the digital Banking exchanges. The rate of protection of this multitude of devices like modems, switches, entire IT installation is also sizeable.

DATA ANALYSIS

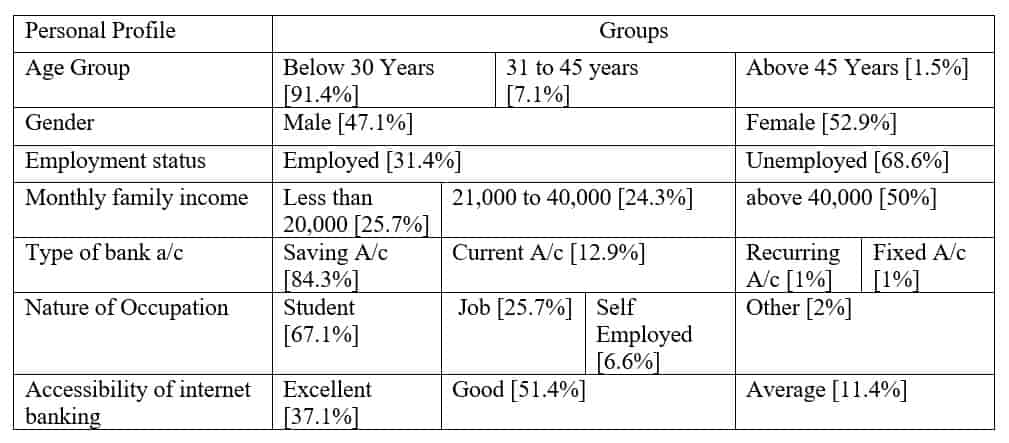

Table 1 shows that sizable no. of the respondent are females unemployed students respondent below 30 years of age with monthly family income up to Rs.40,000 per month, majority of respondents holds saving bank account and follow internet banking for its good accessibility with all devices. Dominant dimension of customer satisfaction on internet banking variables An attempt has been made to identify the Customer Satisfaction on Internet banking of the respondent.

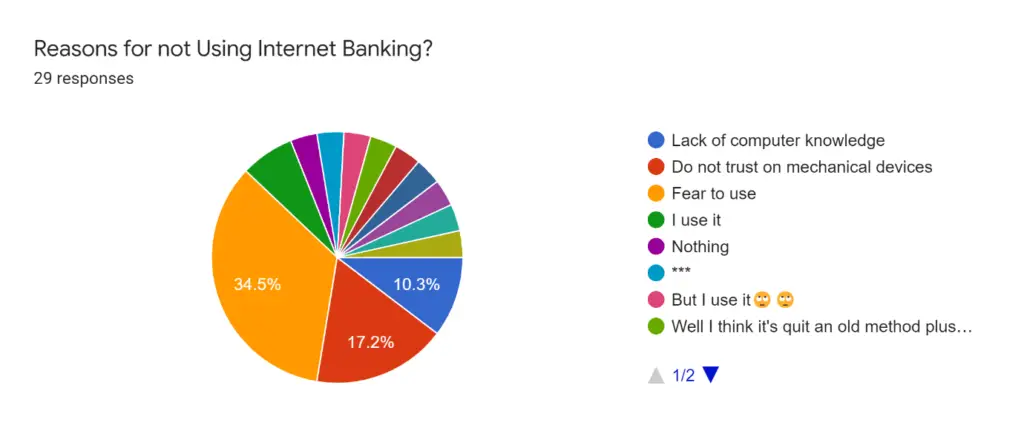

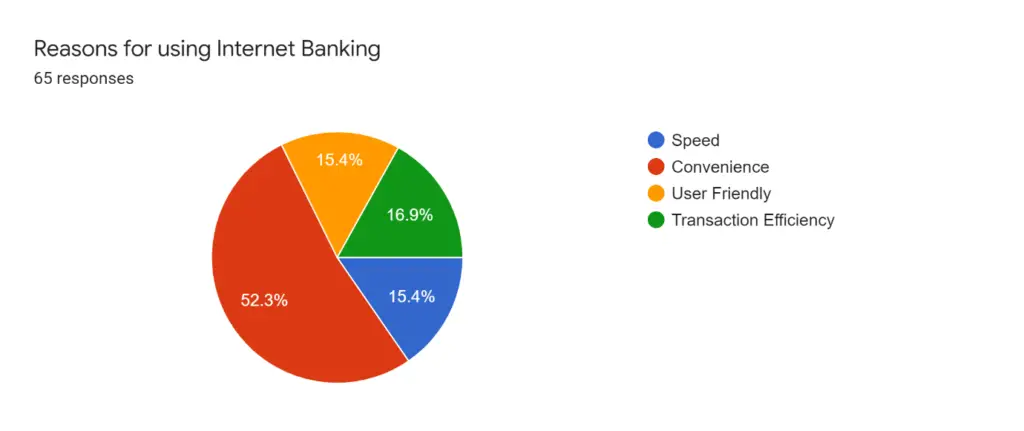

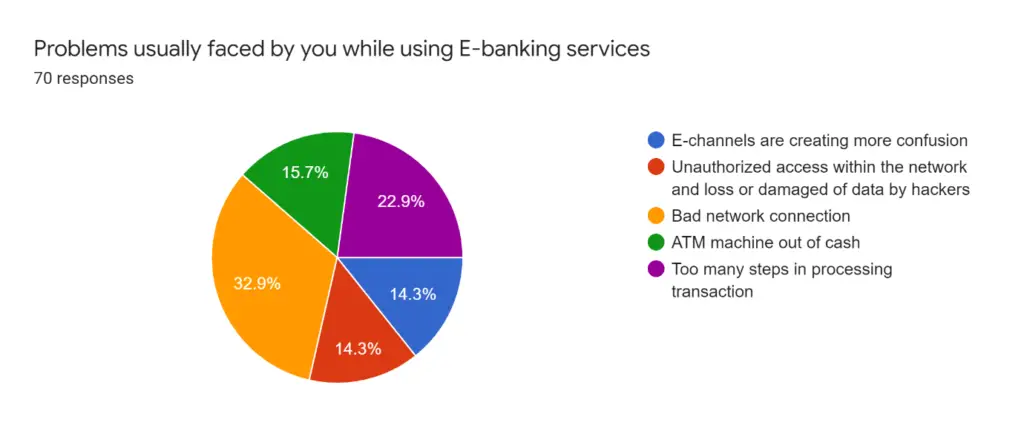

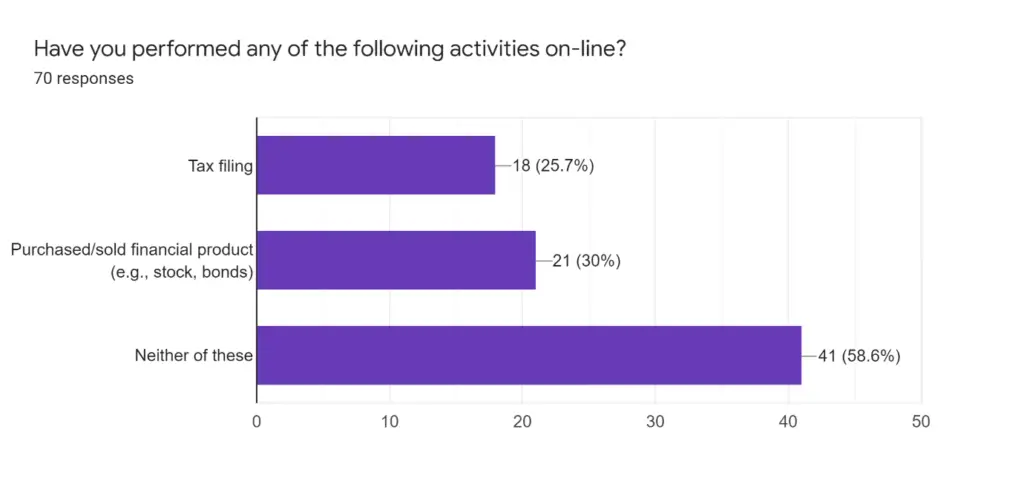

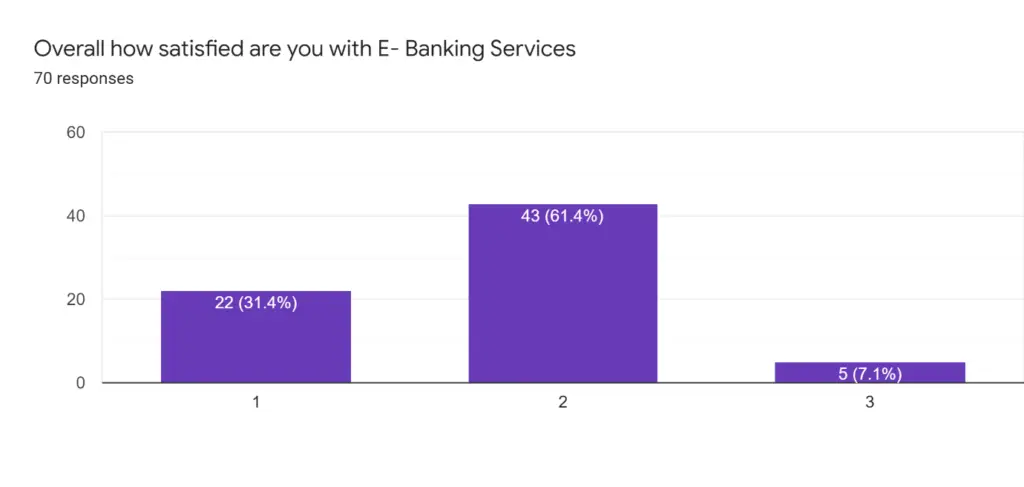

There were in total 94 number of Respondent out of which 29 respondent did not use internet banking and the major number of then said they had fear to use the E- banking this simply tells us that they did not trust e- banking processes some of them also described E-banking as the old method since people are using UPIs on the regular basis and. Rest majority of the respondent uses Internet Banking because of they found it very convenient to use them but during the process majority of them faces the bad network connection. Since tax filing and purchasing/ selling financial product is considered most important financial activity so we included this in our research and found that majority of the respondent did not perform this activities online. Even though majority of the people are satisfied with e- banking but still they do not trust the e-banking process completely.

CONCLUSION

While digital banking can offer some of advantages for clients and new commercial enterprise possibilities for banks, it exacerbates conventional banking risks. Even though giant paintings has been executed in a few international locations in adapting banking and supervision regulations, non-stop vigilance and revisions might be crucial because the scope of e-banking increases. In particular, there may be nonetheless a want to set up more harmonization and coordination on the global level. Moreover, the benefit with which capital can doubtlessly be moved among banks and throughout borders in an digital surroundings creates a more sensitivity to monetary coverage management. To apprehend the effect of e-banking at the behavior of monetary coverage, policymakers want a stable analytical foundation. Without one, the markets will offer the answer, in all likelihood at a excessive monetary cost. Further studies on coverage-associated problems withinside the duration in advance is consequently critical.

This mission ambitions to carry out the demanding situations confronted with the aid of using consumer in working via net banking. Convince, Flexibility and Time Saver are a few of the advantage of the net banking. The demanding situations confronted in net banking are low broadband Internet penetration followed with the aid of using Banks’ Ambivalent Commitment Levels, Fear of Online Threats/Scams, Digital and Financial Divide. It is evidently located that majority of respondent holds saving bank account and follow net banking for its handy right accessibility with all devices. Accessibility of Internet Banking, Network Challenging Factors and Gender of the respondent determines the primary demanding situations of Internet Banking.

REFERENCES

- http://www.businessdictionary.com/definition/banking-system.html (meaning of E banking )

- https://www.google.com/search?q=swot+analysis+of+ebanking&rlz=1C1ONGR_enIN957IN957&oq=swot+analysis+of+ebanking&aqs=chrome..69i57j0i13l3j0i22i30l2.10798j0j7&sourceid=chrome&ie=UTF-8

- https://www.slideshare.net/wahidsajol/analysis-of-e-banking

- https://www.encyclopedia.com/finance/encyclopedias-almanacs-transcripts-and-maps/electronic-banking

- https://smallbusiness.chron.com/importance-ebanking-business-26188.html

- https://www.researchgate.net/publication/320028421_E-BANKING_OPPORTUNITIES_AND_CHALLENGES_IN_INDIA

- https://link.springer.com/chapter/10.1007/978-0-387-75734-6_7

Credit: This final year project on “The Security Challenges Related To Electronic Banking Transactions” was completed by Adiba Parveen, Aditi Joshi, and Tadiwanashe Glenn Shambare Students of Bachelor in Business Administration, Under the guidance of Jyoti Nain, Assistant professor from Galgotias University Greater Noida, Uttar Pradesh.

Leave a Reply