A final year project on “Comparative Analysis Of Nike And Adidas” was submitted by Srashti Kumari (from Galgotias University Greater Noida, Uttar Pradesh) to extrudesign.com.

| University: | Galgotias University Greater Noida, Uttar Pradesh. | |

| Project Title: | Comparative Analysis Of Nike And Adidas | |

| Submitted by: | Srashti Kumari | |

| Authors: | Srashti Kumari | |

| Supervised by: | ||

| Department: | Bachelor in Business Administration | |

| Academic Year: | 2021-22 |

ABSTRACT

This report provides an analysis and evaluation of two of the largest companies Nike and Adidas in the athletic footwear industry. One of the foremost popular products is chosen from each of the corporate to analyze. The report is conducted by analyzing detail into the athletic footwear industry and both companies background, macro and micro environment forces, market segmentation, target markets, targeting strategies and position strategies. Many secondary researches which might be within the appendices to are done to finish the report. The result show that Adidas and Nike have similar market segmentations and targeting market. Both Nike and Adidas have essential roles within the athletic footwear market. For leather footwear market, there are various reasonably shoes involved like casual shoes, sports shoes and dress shoes. The leather footwear market also faces difficulties as fewer consumers spend money on leather footwear and more tends to spend on outdoor footwear.

INTRODUCTION

INDUSTRY OVERVIEW

Indian leather industry is the core strength of the Indian footwear industry. It is the engine of growth for the entire Indian leather industry and India is the second- largest global producer of footwear after China.

Reputed global brands like Florsheim, Nunn Bush, Stacy Adams, Gabor, Clarks, Nike, Reebok, Echo, Deichmann, Elefanten, St Michaels, Hasley, Salamander, and Colehaan are manufactured under license in India.

Many units are equipped with In-house Design Studios incorporating state-of-the-art CAD systems having 3D Shoe Design packages that are intuitive and easy to use. Many Indian footwear factories have also acquired the ISO 9000, ISO 14000 as well as the SA 8000 certifications.

One of the major factors for success in niche international fashion markets is the ability to cater to them with the latest designs and in accordance with the latest trends. India has gained international prominence in the area of Colours & Leather Texture forecasting through its outstanding success in Europe. Design and Retail information is regularly made available to footwear manufacturers to help them suitably address the season’requirementsnt.

The Indian Footwear Industry is gearing up to leverage its strengths toward maximizing benefits.

The strength of India in the footwear sector originates from its command of a reliable supply of resources in the form of raw hides and skins, quality finished leather, large installed capacities for the production of finished leather & footwear, large human capital with expertise and technology base, skilled manpower and relative low-cost cost labor, proven strength to produce footwear for global brand leaders and acquired

technology competence, particularly for mid and high priced footwear segments. The resource strength of India in the form of materials and skilled manpower is a comparative advantage for the country.

In the 1970‟s, the Government initially banned the export of raw hides and skins, followed this by limiting, then stopping the export of semi-processed leather and encouraging local tanneries to manufacture finished leather themselves. India is now a major supplier of leather footwear to world markets and has the potential to rival China in the future (60% of Chinese exports are synthetic shoes).

India is often referred to as the sleeping giant in footwear terms. It has an installed capacity of 1,800 million pairs, second only to China. The bulk of production is in men’s leather shoes and leather uppers for both men and ladies. It has over 100 fully mechanized, modern shoemaking plants, as good as anywhere in the world (including Europe).

The main markets for Indian leather shoes are the UK the and USA, which between them take about 55% of total exports.

India has not yet reached its full potential in terms of being a world supplier. This is due mainly to local cow leather that although plentiful, has a maximum thickness of 1.4 – 1.6mm, and the socio / political / infrastructure of the country. However, India is an excellent supplier of leather uppers. Importation of uppers from India does not infringe FTA with Europe or the USA.

The potential is ready to change albeit slowly, but with a population rivaling China for size, there is no doubt the tussle for world domination in footwear supply is between these two countries.

RESEARCH OBJECTIVES AND METHODOLOGY

RESEARCH OBJECTIVE

- To study the marketing of Adidas and Nike and also about the current condition of Adidas & Nike in market

- To find out that how Adidas hold to the market and what are the areas within which Adidas can improve.

- To study the footwear industry in India with respect to Adidas and Nike shoes. To get the customer, dealer and retailer’s perceptions

METHODOLOGY

PRIMARY DATA

Primary data refers to the pure and the fresh data which are collected first time .

The primary data are collected from the interview schedule for this study.

SECONDARY DATA

Secondary data is collected by a third party and consumed by researchers, analysts, etc.

The secondary data for this study has been obtained from international journal and company website.

DATA COLLECTION METHODS:

The sample size taken was 100 consumers

Sample unit – Shoes Company (Adidas Shoes, Reebok, Bata, Adidas and Nike) The Area chosen was Delhi.

The data was collected by means of

- Questionnaires

- Interviews (formal & informal)

QUESTIONNAIRES

Questionnaire prepared was open-ended, structured, and disguised.

The Questionnaire was designed in such a way that it catered to every aspect of the research objective. It was disguised as the consumer was kept unaware of the product for which the research was being conducted.

Before filling up the Questionnaire, it was thoroughly discussed with them and their views were noted down in the form of facts (answers) in the Questionnaire.

INTERVIEWS

Interviews just like informal discussions were pre-planned. In fact interviews only led to informal discussions. Interviews were formal and in some cases, this was the initial step which led to second & third meeting with the interviewee and they were able to part with the information freely and informally with the researcher.

Interviews were pre-planned (after taking an appointment with them in many cases) very formal and structured.

When this was through, they were asked to fill in one chart with parameters of a footwear industry giving their rankings. It helped in finding out their awareness level and needs.

DATA INTERPRETATION & ANALYSIS

The following is the analysis that is based on the responses filled in by the consumers in the questionnaire. It is calculated with the help of frequency tables, bar graph, pi-charts, etc. all close-ended questions have been included as a part of the analysis and the analysis of the face to face interaction and the analysis of the close-ended questions from the base for recommendations.

1. Income Level (Per Month) of Respondents:

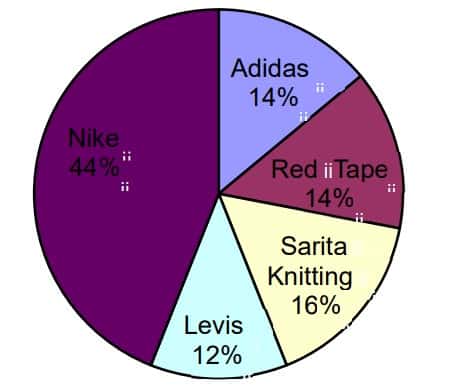

2. Brand preference

- 43.5% prefer Nike

- 12.5% prefer Levi’s

- 16% prefer Sarita Knitting

- 14% prefer Red Tape

- 14.5% prefer Adidas

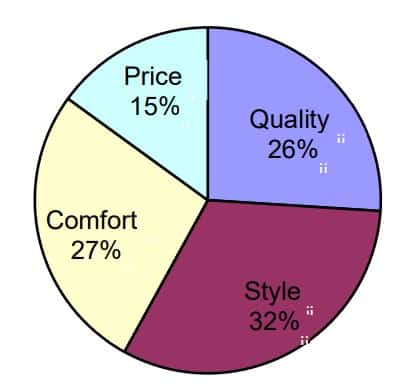

3. Parameter for choosing the brand

- 32% choose on a style basis

- 27% choose on a comfort basis

- 15% choose on a Price basis

- 26% choose on a quality basis

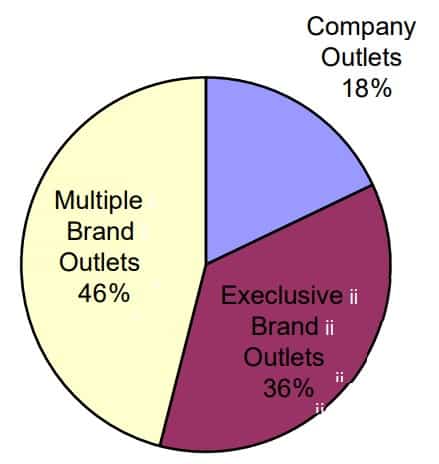

4. Buying Place

- 18% from company outlets

- 46% from multiple brand outlets

- 36% from exclusive brand outlets

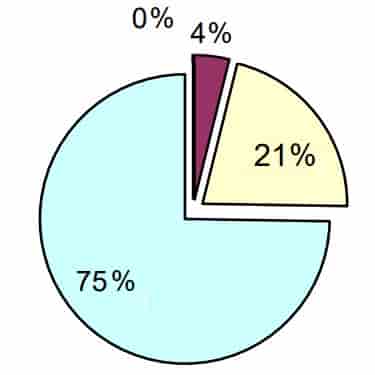

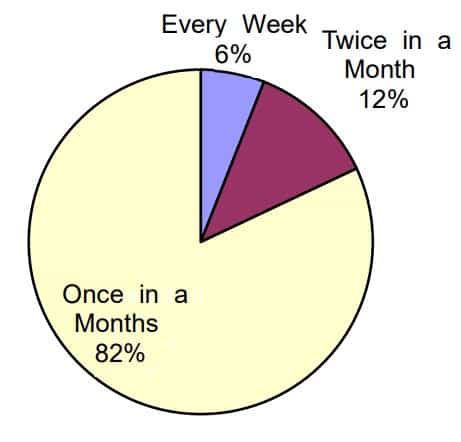

5. Visits to the outlets

- 82% visits once in a month

- 12% visits twice in month

- 6% visits every week

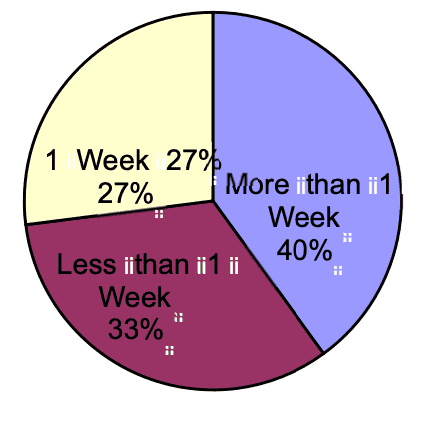

6. Response time was taken by the company in case of defective products?

- 33% customer thinks company takes less than 1 week time in case of any defective product

- 27% thinks company takes 1 week.

- 40% thinks company takes more than 1 week.

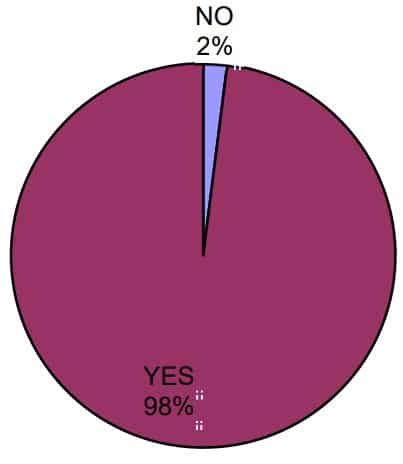

7. Customer Satisfaction with services provided by the company?

- 98% of customers are satisfied with the services provided by the company

- 2% are not satisfied

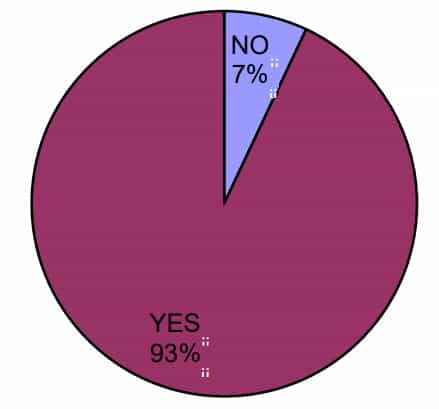

8. Customer Satisfaction with the sales personnel of the outlets?

- 93% are satisfied

- 7% are not satisfied

RECOMMENDATIONS

- Both Company should strengthen its distribution network

- Opening of company owned showrooms is recommended as it should be a place to showcase the latest products

- I recommend the both companies should concentrate in rural areas which it has neglected a lot. I mean smaller cities as the growth potential lies there.

LIMITATIONS

- It’s tough to find data on company was not ready to share data with me.

- Time was a constraint.

- Adidas were apprehensive in divulging the details about company and its marketing strategies thus we tried to get the data from advertisement agency articles and net.

- With the environment being prone to high vitality thus relevance of this project after six months is a questionable thing.

- The focus of study is local in nature as mobility was a problem.

CONCLUSIONS & IMPLICATIONS

Both companies Adidas and Nike have always been driven by its Value-for-money strategy. The corporate must identify critical success factory and work assiduously towards achieving it.

As the world grows to become one, many problems will arise that cannot be solved.

One in every of the primary challenges related to globalization is balancing conflicting and competing objectives. Within the case of Adidas, it has faced such problems already and the way proscribed them is with flexibility and calmness.

Despite what may be higher costs, Adidas has chosen to stay with their right codes and Standards of Engagement instead of still be associated with subcontractors who treat works in inhumane ways. As Adidas has grown worldwide, it’s had to cater to problems of heterogeneity vs. homogeneity. In other words, in an increasingly heterogeneous and global world, diversity within the workplace has looked as if it would emerge as an controversy. Companies, including Adidas aren’t any longer homogenous within the sense that their companies have grown worldwide. And as a result, Adidas has had to form worldwide headquarters and produce information and products in several different languages. Having to spread its workforce, Adidas has come to depend on intangibles. The knowledge, worldwide experience and variety that an Adidas employee can bring to the table are valuable. Recently, how successful companies are in the global world is increasingly derived from intangibles, such as these, that organizations cannot own. Adidas is greatly tormented by these external influences since indeed it is a worldwide company. For a few it’s not common knowledge that Adidas may be a German company. This can be a result of good global business. Adidas has created a product that is global and thereupon diversity and knowledge greatly affect the corporate.

Adidas must be able to easily adapt to different cultures and must be culturally aware when conducting business. The long list of Adidas subsidiaries where it conducts business proves that Adidas is constantly adapting to cultural changes and must be extremely diverse. Because of this necessity, knowledge is greatly valued. Great changes occur in this industry and as a result, new ideas, intuition and inspiration are an asset that is a necessity in this industry and to remain a global company. Who leads this knowledge and maintains diversity are the managers, yet they too are facing new changes.

The world-economy is now passing through the recession period. So it is very difficult either to predict future trend or to decide strategy to boost up export sales. This global recession has also affected the leather footwear industry. But considering it as a temporary phase we can derive some important conclusions like below:

India has a booming garment and shoe market. In various cities there, new shopping malls have sprung up one after another and sellers compete to exhibit latest products while consumers exhibit eager demand for brand products. Many brands expand their businesses through franchised operation, particularly garment and shoe brands. By 2012, franchised operation is expected to hit 6% in growth rate, amounting to USD 17 billion in total value. This means that this market will create substantial opportunities related to franchised operation.

According to insiders, almost all international garment and shoe brands are gloating over the Indian market or negotiating with large textile and garment companies there concerning franchising agreement. With the entry of many large international brands into Indian market, India is beginning to formulate specific laws and regulations concerning franchised operation.

Organized retail scale in India only occurs recently. Adidas is one of the first brands to implement franchised operation and currently, almost all sports shoe brands, including Reebok, Adidas and Nike, are operated in this mode. Indian high- end sports shoe and garment market is expected to achieve 20% growth rate this year.

The current market is shifting from low-price shoes to medium and high-end products, thus attracting a lot of foreign shoe brands to open stores in India. Recently, Clarks opened its exclusive shoe store in India and other brands such as Lotto, Marco Ricci, Valis and Tommy Hilfiger have achieved outstanding performance. Most international shoe brands enter Indian market through different retail channels, including exclusive stores and stores dealing in multiple brands.

Indian high quality shoe market promises great potential. India has a population of one billion. If every Indian buys a pair of Rs. 1000 shoes, this makes a huge market.

Sports shoe market is also experiencing a booming growth. Many international brands such as Action, Adidas and Nike are planning to expand market in India. Holding 47% market share in Indian high-end sports shoe market, Adidas already has about 30 stores there and is planning to open a new store every week to fully cover large and small cities in India. These new stores are mostly franchised stores. India is one of their largest and fastest-growing markets, and it is no problem soliciting franchised operators there. The only problem is that there are too many candidates for them to select.

References

Book/Magazines Referred:

- Berry L.L (1995), “Relationship Marketing of Services-Growing Interest, Emerging Perspectives”, Journal of the Academy of Marketing Science.

- Homer, P., Kahle, L.R., (1988), “A structural equation test of the value- attitude behavior hierarchy”, Journal of Personality and Social Psychology, 54, 638-46. Howard J. (1989), Consumer Behaviour in Marketing Strategy, Englewood Cliffs, NJ, Prentice Hall.

- Kotler, P. (1997), Marketing Management: Analysis, Planning, Implementation and Control, Prentice-Hall, Englewood Cliffs, NJ.

- Kotler, P. (2000), Marketing Management, Millennium Edition, Prentice Hall of India Pvt. Ltd., New Delhi.

- Berry L.L (1995), “Relationship Marketing of Services-Growing Interest, Emerging Perspectives”, Journal of the Academy of Marketing Science.

- Homer, P., Kahle, L.R., (1988), “A structural equation test of the value- attitude behavior hierarchy”, Journal of Personality and Social Psychology, 54, 638-46. Howard J. (1989), Consumer Behaviour in Marketing Strategy, Englewood Cliffs, NJ, Prentice Hall.

- Kotler, P. (1997), Marketing Management: Analysis, Planning, Implementation and Control, Prentice-Hall, Englewood Cliffs, NJ.

Credit: This final year project on “Comparative Analysis Of Nike And Adidas” was submitted by Srashti Kumari, BBA, School of business from Galgotias University Greater Noida, Uttar Pradesh).

Leave a Reply